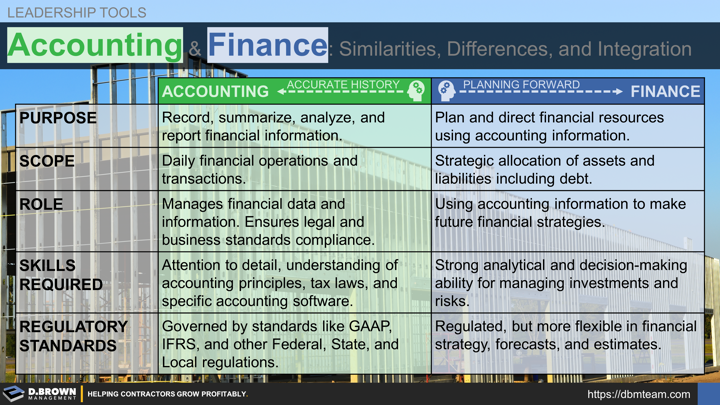

Accounting is primarily about looking backwards and inside the construction business, creating an accurate and timely record of what happened within an agreed-upon degree of precision.

- These will primarily be the four main monthly financial reports for a contractor (Income Statement - P&L, Balance Sheet, Cash Flow Statement, and Work-in-Progress / WIP).

- The forward looking responsibility of accounting will typically end with an 8-12 week cash flow forecast.

- Accounting is also typically the administrative function of the business, ensuring compliance with legal (external) and business processes (internal).

Finance is primarily about looking forward and at the external market using accounting information to create forecasts, develop financial strategies, and strategically allocate the assets and liabilities for the best return to shareholders.

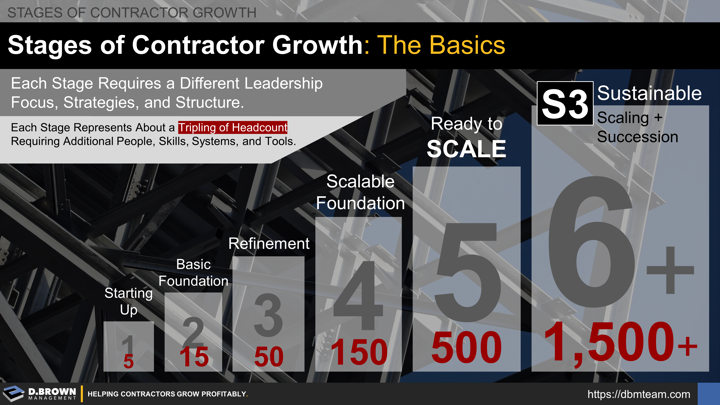

All conditions are different but between Stage 4 and 5 of growth is when most contractors will truly benefit from a dedicated CFO who is focused on the finance aspects of the role 90% of the time. A CFO spends most of the their time with the CEO and Operations, ensuring alignment between strategy, operational execution, and resource allocation.

Up through Stage 4, the Owner/CEO/President is typically serving in the finance function. Depending on their background, most will benefit from an advisor with CFO and Business Management (contracts, technology, HR, etc.) experience at Stage 5+ companies for development.

Your CPA is a great place to start and always a valuable partner but unless that CPA has operating experience as a CFO or Business Manager at company one or two stages past where you are currently at, their advice in this area will have gaps.