Robust information systems about the external market are a critical part of this decision making process.

There is no amount of information that will guarantee success in these choices.

There are a wide range of resources for information about the external market. Each has a different approach and different limitations.

The external and internal information systems along with the process of making these choices will vary widely between different contractors and will change dramatically with each stage of growth.

We start by breaking these up into three primary areas of the business:

- Market: The overall economy, specific industry sectors, specific geographies, project delivery methods, regulations, and financing.

- OpEx: Operational excellence including functions like supply chain, virtual construction (BIM), fabrication, and technology.

- OrgDev: All things talent related including demographics, broader cultural trends, and education programs.

Your information systems, choices, and execution around all three of these areas must be integrated and aligned with both your stage of growth and the development phase of your management team.

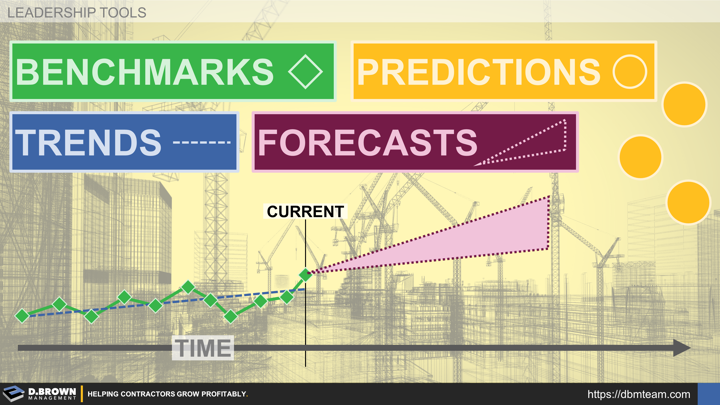

We break those up into four subcategories progressing from the most tangible and current through the most ambiguous and futuristic, with each having both incredible value and limitations:

- Benchmarks: Consolidated factual information at a moment in time whether it is financial performance such as CFMA, salary information such as PAS, or broader construction put-in-place from the US Census Bureau. It is important to understand factors that can massively skew this information. For instance, whether a contractor is or is not set up as a pass-through entity for taxes can have a massive impact on how net profits or executive bonuses are reported. It is just as important to understand the wide range of inputs that lead to "Average" benchmarks.

- Trends: A series of benchmarks over a historical range. These can be incredibly helpful in forecasting into the future. When evaluating trends, it is critical to understand how they are being put together such as whether they are inflation adjusted or not.

- Forecasts: Based on a combination of multiple trends and different modeling tools, these provide a range of probability-weighted outcomes looking forward a finite period of time into the future, typically 3-5 years. FMI is a great example of market forecasts.

- Predictions: These are still based on trends but are more general in nature, longer-range, and sometimes without a connection to a finite timeline. Examples include the many predictions about robotics and construction. It is important to understand the biases and context of the people making the predictions. For example - a robotics company may be a lot more bullish on robotics than a labor union, and neither one has a perfect crystal ball.

The sources referenced in this series are not meant to cover everything. They are a starting point. Each contractor will have to develop and continually improve their information systems over time.

Please contact us and schedule time to talk with one of our team members who is most familiar with your particular market(s). We are happy to provide any insights we have as you develop and refine your process for making strategic choices and allocating major resources.