Especially if the exit strategy is selling to a strategic buyer or merger with another contractor.

With a combination of generally negative media attention and contractor’s general unfamiliarity with what investment bankers really do causes them to have reputations almost as bad as consultants.

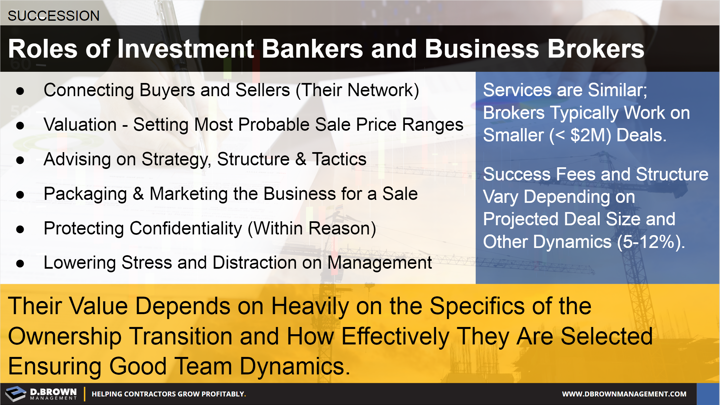

With that bit of humor out of the way, let’s focus on the value that an investment banker brings to the table:

- There isn’t a “dating” website listing all contractors that might be interested in buying or selling that you can browse on your phone by swiping right or left. Investment bankers have a network, know the market, know the players, and have systems to develop a qualified list of prospects for either buying or selling.

- With that knowledge, they can help set reasonable market valuation, advise the contractor on the best approach, and “package” the business to market it effectively.

- Within reason, the investment bankers can keep everything confidential. Though, if your business has some unique characteristics, those characteristics are easy enough to identify.

- They can also handle many of the details behind the scenes, allowing management to continue focusing on running the business.

Their value-add heavily depends in the specifics of the deal and a contractor should rigorously interview different investment bankers helping ensure a good fit.