Simply due to age demographics in the United States, there will continue to be an increasing number of contractors going through some form of an ownership succession.

The transaction details can be incredibly complex with all the legal paperwork, tax structures, and integration with the key financial partners, including banking and surety.

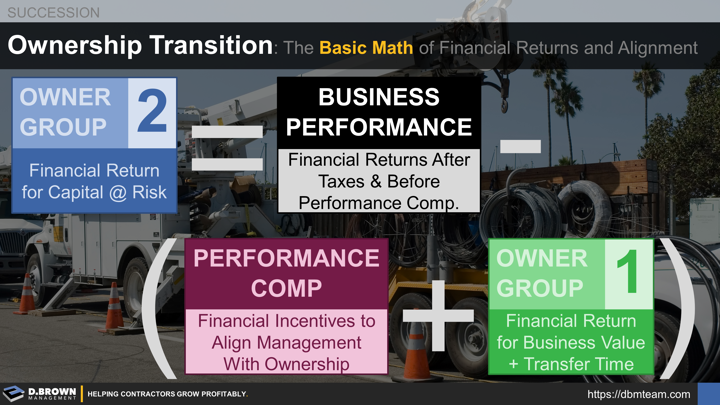

Sometimes, it is best to back up and look at a really simple model to keep the three primary parties focused on what is truly important.

- Owner #1 (Current): Needing a financial return for the business they have built.

- Owner #2 (Future): Needing a financial return for the capital they are putting at risk.

- Management Team: Ensuring the business continues to run well and needing a return on their professional time invested.

These are the three primary groups and may share members, but each should be viewed separately with separate needs and risks.

The market sets the bar for what each of these parties deserves as a return on their capital (owners) or return on their time (management). Each party MUST get at least market value for their capital at risk and their time.

The construction business is the goose that lays the golden eggs and it is ultimately the consistent quantity of those eggs laid over time that make any deal work. Stephen Covey describes this as the P/PC ratio.

Looking at this simple formula, the ONLY variable is the business performance. Therefore, all three groups must be deeply aligned in how to make the business perform better in regards to financial returns in the short, mid, and long term.

Too often, we see teams going through an ownership succession with each trying to sub-optimize their own returns at the expense of the other parties. Focus gets taken away from optimizing the construction business and returns for all parties suffer - they are dividing up a smaller pie.

If all three groups are not 100% focused on business performance, there is no deal structure that will work. Deal structures will not create capital, cash, capabilities, or trust.

Please contact us to review a simple model for your business and basic comparison to industry benchmarks to evaluate the range of possibilities for an ownership transition.