Few things to qualify:

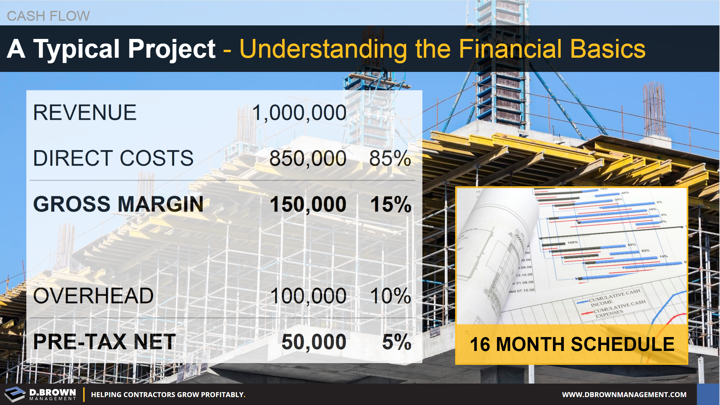

- Different types of contractors such as GCs, general engineering, MEP and other subcontractors will have different levels of profitability. This is a general overview.

- Each contractor will vary what they call direct costs, indirect costs and overhead. Pretax net profit as compared to how much capital (cash) they require is the best bottom-line measure when comparing.

- For more financial benchmarking information look at CFMA or if your CPA firm has a construction specialty they will often develop benchmarking reports.

When looking at millions of dollars it is easy to get lost in large numbers. Let’s break this down to a $1,000 paycheck. You would have $50 left over at the end of the week after you paid all planned expenses. This would have to cover taxes (40-50%), any unplanned expenses like a car repair and any discretionary spending like going out to dinner.

Contractors don’t make money by managing millions of dollars in revenue. They make money through each person on the team managing each of the 480 minutes in a day and each dollar they spend trying to save a few minutes and dollars each day.