Talent shortages in the construction industry will continue to worsen through 2030, especially given the longer-term development funnel required. Building a talent model that is aligned with your business model provides a foundation for your Talent Value Stream (TVS).

What's the difference between a model, plan, and system?

A model is a representational framework that simplifies and explains how something works or is structured. It is a testable representation of reality that you can experiment with. This may be a diagram, a mock-up, or a spreadsheet model. For example, here is a diagram representing components of a construction business and a financial model.

A plan is the sequenced set of actions required to achieve an outcome. It is specific and detailed, including who, what, where, when, how, and for how much. Good plans are the prerequisite for building good projects—the same goes for business plans that turn strategic choices into objectives, key results, leading activities, and measures.

A management system is the engine that keeps the plan on course and helps refine the next iteration of the model. An example of that may be the dispatch system that takes inputs from several sources including, Short-Interval-Plans (SIPs) and optimizes the field workforce across all projects. Another example of a talent management system would be the recruiting process, starting with identification, definition, and approval through searching, screening, hiring, onboarding, and integrating.

What goes into a basic talent model?

There are two basic components of a talent model:

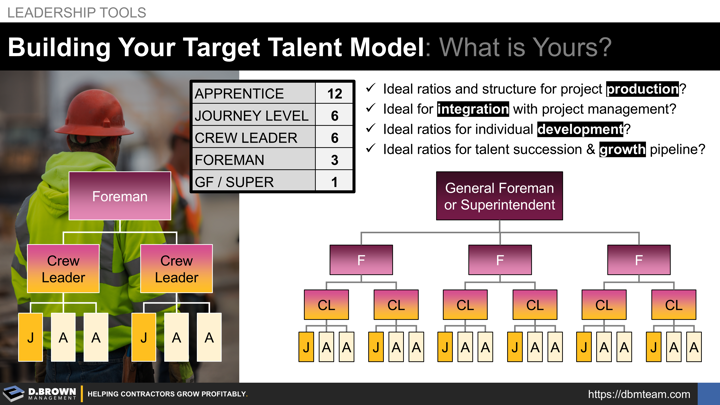

- The structure and ratios around a related set of job roles. For example, what does the field workforce look like from Superintendent through Apprentice?

- Key metrics around those roles including

- Base compensation

- Total cost (burden, benefits, and possibly applied indirect/overhead costs)

- Production rates per hour, week, month, or year such as revenue, margin, or some other unit of production

- Turnover per year (leaving the company)

- Promotability per year (moving to another job role)

- Selection metrics - how many candidates does it take to get one good hire?

- Developmental timeline and percentages - approximately how long does someone need to be in the role before they are promotable, and what percentage of people are promotable from one role to the next? For example, what percentage of apprentices starting their first year will turn out to be qualified journeyman by year five?

You likely won't have all the metrics and only a few metrics will matter per role. That is part of tuning the model. You will see which of the metrics matter the most. That can inform changes to your strategy, plans, and management systems.

What are the key considerations around structure and ratios?

Remember that this is not a project level staffing plan that takes into account specific requirements of a particular project or the field workforce you have available to you at the moment. This is a model that is one level of abstraction removed from that—like a typical detail on a set of construction docs or an estimating assembly or crew.

You may have several different models based on parts of your business that have different operating dynamics, but make sure you don't try to get too granular—you are building a model, not a plan.

Building a model is an iterative process. Once you've done a little digging in, discussing, and debating with the team, just make a decision and lock a metric to start with (5D for Alignment). If the team feels something is 70% correct, that is good enough for the first pass. You will be going through several iterations to test the metrics and ensure they integrate.

Get a small team that has a deep understanding of the function—for example, the field workforce—but also looks at it from different perspectives, including safety, quality, productivity, development, succession, and integration with other teams like design, purchasing, fabrication, and project management.

- Target a 5-8 person team to start building your model.

- Start by discussing the "ideal" structure and ratios for each aspect (see below). You will work on optimization second.

- Spend time looking up actual data you have about your current workforce—to the extent you have it.

- Talk through specific anecdotal examples of people to add context to the data.

- Look for examples that represent all aspects of the bell curve—top, middle, and bottom. This range of stories will help align everyone in the room.

The questions to ask include:

- What are all the roles in the function—including both official and unofficial roles? For example, a crew leader often plays a critical role in how fieldwork gets done, yet may not appear as an official job title. The same goes for a crew member focused on material logistics.

- What does the ideal structure and ratios of the roles look like for ideal production while meeting the safety and quality standards expected? This is a valuable discussion topic, as it often varies by scope of work. It also tends to be emotionally charged due to personal experiences and frequent gaps in objective feedback data.

- What is ideal for individual development? For example, a 1:2 ratio of journeyman to apprentice may be best for productivity, but a 1:1 or even 2:1 ratio may be ideal for the development of that individual apprentice. This is where both data and anecdotal examples are especially helpful. You will likely find that about 20% of your journeymen and foremen account for 80% of the impact on developing apprentices.

- What is ideal for your talent succession and growth pipeline? This is an area where data can be especially valuable. For example, you may have a 30% annual turnover rate for journeyman hired directly into the role, but fewer than 10% turnover for journeyman who served as apprentices with your company in their last year or more.

- What is ideal for integration with other functions, including project management and safety? What job roles across functions align most effectively?

Time-box discussions around each role and these questions to 20-30 minutes for the first round. You won't get it perfect—the important thing is to see the range of how each person on the team thinks through these and the range between the different questions.

Take a break after this and reset yourselves. This may be a separate meeting, or just a continuation. Maybe even include a little box-breathing in between to get everyone ready for the next part.

From Ideal to Optimized Target

The basics that you need for defining optimized targets are:

- What's your 3-year business outlook—even rough targets? How much do you expect to grow?

- What's your current organizational chart and workforce look like for whatever function you are modeling, including and estimate of who will likely be retiring in the next 3 years?

- What does your opportunity pipeline look like? Are you saying 'no' to good opportunities with good customers due to lack of talent capacity in whatever function you are modeling?

- What is your current average cost per hour (or year) for the different roles you are modeling? This is essential to help make optimization decisions, beginning with the baseline of ideal productivity ratios.

When you make your first pass at what the optimized targets are, you will have to do some rough operational math—you can refine it later. For instance, if you are planning for growth and you know that "home grown" apprentices turn into more productive journeymen, have a lower turnover rate, and higher promotability to become foremen, then the math may look like this:

- If field labor cost runs about 20% of revenue...

- And we shift from a 1:1 ratio of journeyman to apprentice to a 1:2 ratio, that will lower our average crew cost, but...

- We have to account for the lower productivity due to inexperience and plan for training time. So if we assume the overall crew is only 90% as productive, then effectively, the crew cost will go up by about 6%...

- Which will impact current bottom-line net profits by about 1%...

- But we will be pulling through 30% more journeymen from our apprentices each year...

- And since we have a higher retention and promotion rate, over a 5-year period of time, the additional profitability from growth will have a return that is higher than our current return on capital...

Remember that this is just a hypothetical example—you need to do the math, as each situation is different and markets change rapidly. The value of having a model built is that you can change a few inputs and see what impact they have on the outcomes.

What do you do with the model once you have the initial optimized targets defined?

Three main things, with lots of nuance to each:

- Evaluate your current talent strength in each role against the model. Strength is defined as a product of both quantity and quality.

- For example, let's say your model requires 28 foremen given your current workload and backlog. You have 22, with the gaps being covered by them being stretched thin and your superintendents taking on some of the responsibilities on certain projects—you are at 78% on quantity.

- You have an evaluation and feedback system for foremen that the superintendents review quarterly. The latest evaluation shows that, of the top ten key results and critical tasks expected from the foreman role, they are performing at 80% on average.

- This puts your strength level for this role at 63% based on your model.

- Refine your model based on actual metrics, including project outcomes. Based on the example above, is there a material difference in the project outcomes, including safety, between foremen with different evaluations? Is there a difference in the development of people working for them? This helps you determine the "sensitivity" of outcomes and supports prioritized decisions about improvements.

- Make prioritized improvements to your plans and management systems, and possibly your strategic market choices. For example, if your analysis shows a significant performance gap between foremen, then you would want to look at several improvement possibilities, including:

- What are the specific gaps in foreman performance that are causing the biggest project problems?

- Can those gaps be closed with improvements to the management system—for instance, planning?

- Do you have the right managers in place above them? This is often where gaps begin.

- Can those gaps be closed with training? Only look at this after you have prioritized the gaps and improved the management systems.

- Are there people on the team who could be promoted into the role, helping close the quantity gap, and with the right aptitudes, that you can expect them to be at 100% for the quality of their capabilities within 3-12 months?

- Are there people who can be recruited into this position that you have been courting?

The model allows you to have these discussions and invest proactively—in advance of the daily demand of project execution.

What functions should you do this for, and to what level?

We recommend focusing this effort on high-volume roles. A starting point would be any role where you expect to have more than 10 team members in that role in your company over the next 3 years, along with 1 managerial level above that.

Please reach out with any questions about how to integrate your strategy, business model, talent model, business plans, and management systems.