Note - If this article, associated reference material, and recommendations seem too long, you've obviously been fortunate enough to never experience how long it takes to work through a bad project. :)

A contractor’s bottom-line starts at the top-line and the work they choose to take on. This includes how much gross margin is in the project and the risk of achieving that gross margin. Consider that benchmarks are just averages and that there are many contractors operating consistently at 2X industry benchmarks while others are operating at half that. Work taken on must fit the metrics of your business model, that is the first and most basic go or no-go.

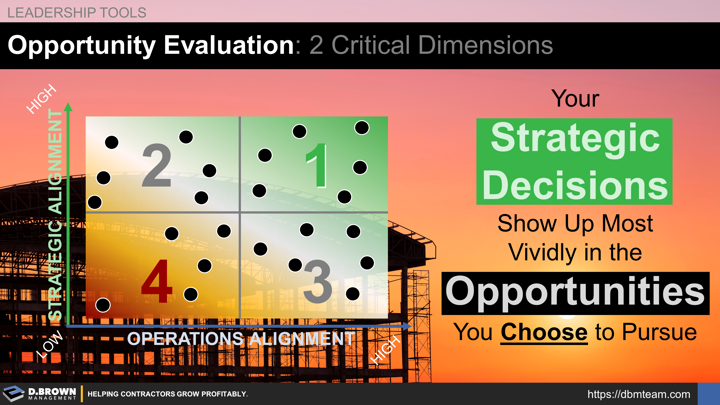

Now let's back up to strategic decisions and business development which is where opportunities begin. Strategic decisions are the highest leveraged choices a leader makes, and your strategic market choices show up most vividly in the opportunities you see and choose to pursue.

Business development is the process of creating new business opportunities through targeted networking, education, and awareness building activities.

The outcome of great business development is a pipeline of opportunities that is at least 80% aligned with your strategic decisions and several multiples (5-10x) of your operational capacity. This will allow you to choose the best opportunities to pursue while ensuring you are continually building more capacity and capabilities. More about business development starting with four basic facts.

As a side note, the other key outcome of great business development is knowing about potential projects and construction programs very soon after the project owner first starts thinking about it. More about this with Bechtel's philosophy on business development.

OPPORTUNITY SELECTION CRITERIA

Depending on the market dynamics and stage of growth that a contractor is in, some of these may be more or less applicable. These are just guidelines for the process. These need to be continually revised as a contractor navigates the different stages of growth, requiring changes to their market strategies, operational capabilities, and capacity.

Strategic Alignment

- Right Market Sector(s)

- Right Scope(s) of Work

- Right Geography(s)

- Right Customer(s)

- Right Size

- Right Contractual Terms

- Right Margin and Cash Flow for Risk

Operations Alignment

Each of these must be evaluated based on a combination of capabilities and capacity required during the expected timeline of the opportunity.

This includes capacity and capabilities that can be reasonably built. For example, adding 50 people to the field workforce may be impossible for some contractors to do in two weeks but if the project won't start for nine months, many contractors could add that capacity.

- Preconstruction & Estimating

- Design

- Prefab

- Craft Labor

- Field Management

- Project Management & Administration

- Equipment

Strategic Choices and Operational Execution must be aligned for sustainable and scalable outcomes.

What is the expected value of the opportunity?

This is ultimately what you are analyzing - across several dimensions, including:

- Financial returns - profitability and cash flow

- Building operational capabilities and/or capacity

- Reputation and Relationships - and building future returns

This 17-minute video from Annie Duke (Thinking in Bets / How to Decide / Quit) is well worth watching as you think about expected returns.

This evaluation and decision making is typically in three stages:

- Decision for the person(s) developing the opportunity to develop it further, meaning it is enough of a fit strategically and operationally to move forward investing those resources.

- Decision to commit additional resources for preconstruction and estimating.

- Decision on setting the sell price of the project (or fee if CMAR work) based on a combination of the risk that is in the project, the competitive environment, other opportunities available, and to what degree this project is aligned operationally and/or strategically.

What would have to be true?

If the opportunity is a high strategic fit but poor fit operationally, ask yourself what would have to be true for this to be a good operational fit? If you can define a clear answer such as scope, scheduling, or contractual terms it may be worth asking. We are continually amazed at how far a project owner will go to get the right contractors on their projects.

P.I.C.K. the Right Opportunities

When evaluating opportunities at the earliest stages, think about them like you would on a P.I.C.K. chart (Possible, Implement, Challenge, Kill).

- What opportunities do you Kill because they are high risk and low return? Good business development should rarely be bringing those to the table, but they will come into the pipeline. Know your criteria clearly for these.

- What opportunities do you Implement immediately because their return is so high and risk is so low?

- What opportunities are Possible because they are both lower risk but also lower return. This is the dietary equivalent of calories that aren't bad for you but aren't that nutritious. If there is no other food available, then you might possibly want to eat them.

- What opportunities do you have to Challenge because they are both high impact and high risk? These are the difference makers for contractors and can either set you apart by taking you to a higher level playing field or take you off the playing field all together. This is where the rigor of the go / no-go process really comes into play.

Every contractor is doing some form of this evaluation. At stages 1-3 of growth, this is likely concentrated to the owner, and they run a "Go/No-Go" process in their heads constantly. Beyond that stage of growth, it is important to start codifying that thought process into more formal processes, including decision rights for different levels of opportunities.

Notes from Our Experiences

We have the opportunity to see contractors of all types and stages of growth from across the country over a long period of time. Below are a few observations related to opportunity evaluation.

- All contractors that we see consistently performing at 2-3X industry benchmarks for profitability and cash flow have one thing in common - they simply won't pursue work that isn't a good fit. All have good operations; some have great operations but that is not the differentiator. Some are much better at their talent management and others are behind - that will show up in scalability, sustainability, and succession, but the top of the scoreboard in the shorter-term is largely about great opportunity selection.

- We have seen plenty of examples where decision rights around opportunities to pursue and final sell pricing are highly concentrated. Nearly all of these lead to great financial results. They also lead to key executives being stretched very thin causing key-person risk, impacting life balance, impacting growth and most importantly impacting succession.

- We have seen just as many examples where the decision to pursue is loosely defined and poorly delegated to many others. Sometimes this is rationalized as decentralization to build entrepreneurialism. In most cases, this is done way too early and with far too loose of guardrails, resulting in a combination of inconsistent results, fragmented strategy, and a struggle to gain any competitive economies of scale while growing.

- We too frequently see individuals and teams getting "Summit Fever" as they start pursuing an opportunity. This is a normal human tendency due to a multiple cognitive biases and logical fallacies that we all have. The relentless pursuit of winning is critical for success but extremely dangerous if there is not a rigorous go / no-go process in place. Many disasters from United 173 (1978) to Challenger (1986) to Everest (1996) have deep roots in the team getting "Summit Fever." The same happens far too frequently to contractors leading to highly volatile below average outcomes, or worse.

The best path is in balancing these three, but that balance is incredibly difficult.

- Start to build a structured process as early as possible even if you are the only one using it.

- Start with something simple and pay attention to how you choose the opportunities to pursue.

- What questions do you ask yourself? Write those down and use that list, each time constantly refining and re-ordering it.

- How do the answers to your questions factor into your decisions? Jot down your notes about the "why" behind each question and what you are looking for.

- Start to share these with someone else on your team.

- Have them shadow you while you evaluate an opportunity going through the questions and having dialog about what you are thinking and why.

- Have them evaluate an opportunity on their own in parallel to you ("Double-Do"). Compare the differences in your decisions and most importantly, how you arrived at them.

- After doing 10+ in parallel where you see consistency in outcomes, formalize decision rights for that person to decide on opportunities within a specific set of criteria.

- Spot check (not second guess) their decision-making process (Quality Assurance) and results (Quality Control) on a reasonable sampling basis, perhaps 5-10%, and then providing them feedback.

- Repeat this process at the next tier of opportunities as your company continues growing. This includes training others to follow this process.

What you will see in this process is a pipeline of talent being developed that can evaluate the full range of opportunities you have coming in the door.

Strategic Decisions are the highest leveraged choices made by the leader. The next two highest leveraged choices made are (1) the people who are on the team which includes both hiring and firing, and (2) the opportunities that get pursued.

There are many nuances to this. Please contact us and we will share freely anything we have learned that will help you improve your opportunity evaluation process.