Here are some things to consider:

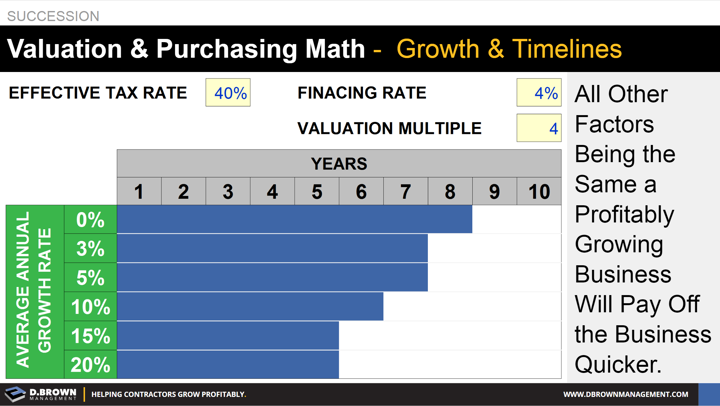

- If the business was already on a strong growth trajectory, then that will be built into the valuation and likely won’t change the pay-off timeline.

- If the business was valued during peak performance or just before an economic downturn, such as being valued in 2008, then it was likely overvalued and will take longer to pay off, creating a lower return for the buyer and potential payment risk for the seller.

- Business growth requires additional capital to manage, so unless the new management finds a way to make the business materially more capital efficient, then some of the after-tax profits each year will have to be retained for working capital with the remainder going toward paying off the business.

- Even if the capital comes in from the outside, such as in the case of a third party buyer or merger, the timelines still apply because that is how long their capital will be tied up before they even start to see a cash return. It is like having your money tied up in a 10-year CD at a bank and then after ten years, you can start to receive the interest payments (profits) each year while your original capital is still tied up.