Cash Flow

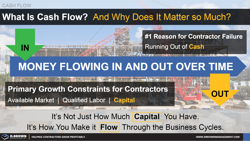

Great cash flow is a key driver of valuation and successful successions. Running out of cash is is the #1 reason contractors fail. Improving cash flow improves your Return on Equity. Protect yourself and never let cash flow be the limitation to your profitable growth.

Cash Flow Explained

Contractors run on very thin profit margins however cash flow is even more important for sustainable growth. Poor cash flow is a primary reason for contractors failing or their profitable growth being seriously constrained.

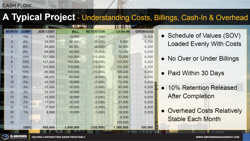

A Typical Project - Project Profitability and Understanding the Basics

It is crucial for everyone in a construction company to understand the financial basics of a project. Contractors have razor-thin profits and relatively high risk.

A Typical Project - Understanding the Basics of Cash Flow

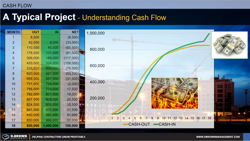

Previously we looked at a typical construction project's profitability basics and covered a brief description of cash flow. Now let’s get into the basics of how that looks over the course of the project with a simple model of a 16 month project.

A Typical Project - Cash Flow S-Curve

Ensuring great financial outcomes is the ONLY way to build a sustainable construction business that can serve customers and develop team members over the long-term.

A Typical Project - Understanding Cash Flow at the Company Level

As contractors face many opportunities in the market it is important to keep cash flow management top-of-mind. Growth eats cash and just a few hiccups in execution can put just about any contractor in a very bad position.

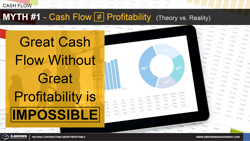

Cash Flow Myth 1 - Profitability Does Not Equal Cash Flow

Cash flow does not equal profitability. While in theory these two critical scoreboard metrics are disconnected in reality cash flow is a pretty reliable predictor of profitability both good and bad.

Cash Flow Myth 2 - Finance Manages Cash Flow

Finance people manage cash flow. The reality is that by the time the finance team gets involved in a cash flow problem there are very few levers they can pull.

Cash Flow Myth 3 - Having Enough Capital

We have enough capital to not worry about Cash Flow. From the time this type of thinking starts to permeate the organization it is just a matter of time before there will be a cash flow crisis.

Cash Flow Myth 4 - That's What Our Bank and Credit Line are For

Fact: Banks will only finance a portion of your cash flow needs. They will have specific requirements related to how much working capital you need to have invested of your own.

Lean Principle - Kaizen (Every Detail Matters)

As contractors build their businesses, it is important to look at every detail from the first meeting with a potential customer through winning and building the project. This same attention to detail also applies to supporting operations and talent.

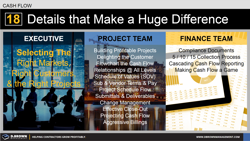

field productivity lean construction18 Details That Make a Huge Difference in Cash Flow

There are 18 tactics contractors can use to improve cash flow at the project and the company level.

Cash Flow Tip 1 - The Right Markets and Customers

Finding the Right Markets & Customers. Keeping in mind that you can’t have great cash flow without great profitability the first thing you have to look at is your market strategy.

Cash Flow Tip 2 - Winning and Building the Right Mix and Velocity of Projects

It seems obvious but the first thing you must do is consistently build projects that meet or exceed your budgeted profit expectations.

Cash Flow Tip 3 - Contractual Details Matter

The reason we are called contractors is because we work off of a contract that defines the scope and terms of what we build. How we negotiate and manage the contract determines cash flow.

Cash Flow Tip 4 - Delighting Your Customers

Delight Your Customers - Both Direct and Indirect. All other things being equal your cash flow will be better if your customer is delighted with the work you have done. They are more likely to:

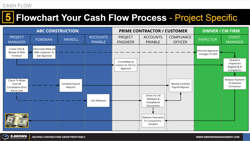

Cash Flow Tip 5 - Flowchart Your Cash Flow

You can only see the full value-stream of cash flow including the waste, the people and the opportunities for improvement by mapping out every step.

Cash Flow Tip 6 - Build Relationships

Build Relationships at All Levels. There isn’t a “Computer” that is negotiating your contract with you, approving your Schedule-of-Values, approving your billing or ensuring timely payment for you. It is the people.

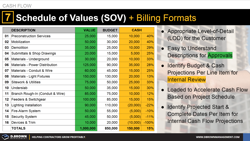

Cash Flow Tip 7 - Schedule-of-Values

Having a good SOV and billing format will set you up for cash flow success throughout the project.

Cash Flow Tip 8 - Subcontractor and Vendor Terms and Pay Schedules

As important as it is for you to have a great Schedule-of-Values (SOV) with your customer, it is equally important to have great terms with your subs and vendors.

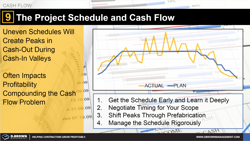

Cash Flow Tip 9 - The Project Schedule and Cash Flow

The smoother the project schedule is, the smoother your cash flow will be. Large variations in the resource loading across a project’s duration impact cash and productivity.

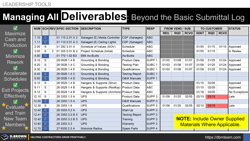

Managing All Deliverables - Beyond the Basic Submittal Log

Maximize your people, projects, profitability, and customer relationships by making your submittal log and process a little less "efficient" and a whole lot more effective.

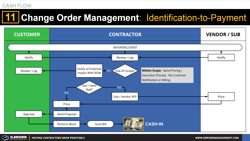

cash flow field productivity project management submittalsCash Flow Tip 11 - Managing Change Orders

A well managed change order process will have a hugely positive impact on customer satisfaction, profitability, and cash flow. Poorly managed, this will negatively impact all three and will sometimes impact cash for years.

Cash Flow Tip 12 - Rapid Close-Out = Good Cash Flow

If you effectively manage the startup and the close-out of the project, then the execution in-between mostly takes care of itself.

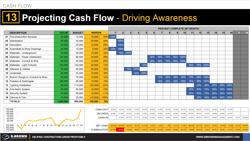

Cash Flow Tip 13 - Projecting Cash Flow and Driving Awareness

Projecting Cash Flow drives awareness, learning, actions and, ultimately, improved cash flow.

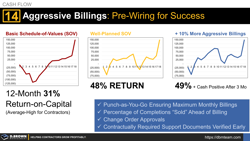

Cash Flow Tip 14 - Aggressive Billings and Pre-Wiring the Process

Contractors can significantly improve their Return-On-Capital by being aggressive and focusing on the details of monthly billings.

Cash Flow Tip 15 - Contractual Compliance

Compliance with Contractual Requirements to avoid getting your payments held. Each contract, including the specifications, will have specific requirements for what you need to do each billing cycle to get paid.

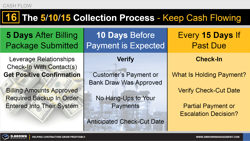

Cash Flow Tip 16 - 5/10/15 Collection Process

Use the 5/10/15 Collection Process to ensure faster payments. Don’t let the marginal gains achieved so far with Cash Flow Tips 1-15 get squandered by poor collection practices.

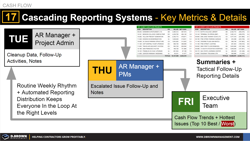

Cash Flow Tip 17 - Cascading Reporting Systems

Developing rigorous weekly Operating Rhythms in your business will help everything run smoother just like they do at the project level.

Cash Flow Tip 18 - Making Cash Flow a Game

Imagine creating a culture where everyone ran into work with the same energy that fans and players run into a sporting event.

Cash Flow - 18 Tips to Improve Cash Flow Scoreboard

Construction contractors can use these 18 specific tips to improve their cash flow scoreboard.

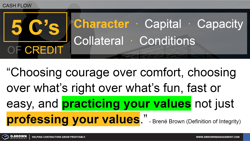

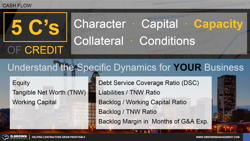

Cash Flow and the 5Cs of Credit - Overview

Contractors need strong financial partners, including banking, surety, and insurance to grow sustainably. It is important to understand how they evaluate your contracting business.

Cash Flow and the 5Cs of Credit - Character

Out of the 5C’s of Credit, character is the one that takes the longest to develop and can be lost in an instant. Character is like your safety EMR in that it is a multiplier for the other C’s, including how much capital you will need to leverage.

Cash Flow and the 5Cs of Credit - Capital

The 2nd of the 5Cs of Credit is how much capital you are putting at risk, along with your financial partner. Contractors should design and follow their own capital management policies appropriate for their business.

Cash Flow and the 5Cs of Credit - Capacity

The 3rd of the 5Cs of Credit is how much capacity your business has to profitably build the projects, ensuring payback of the loan or minimal risk in the case of insurance or bonding.

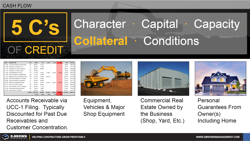

Cash Flow and the 5Cs of Credit - Collateral

The 4th of the 5Cs of Credit is how much and what type of collateral the contractor will put up as a guarantee. The collateral requirements change significantly as contractors grow.

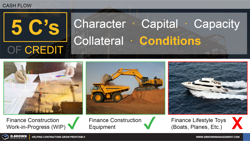

Cash Flow and the 5Cs of Credit - Conditions

The 5th of the 5Cs of Credit are the conditions for the loan, which is primarily what the funds will be used for. These conditions are here to protect the contractor as much as they are there to protect the bank.

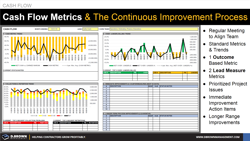

Cash Flow Metrics and The Continuous Improvement Process

Contractors can focus on 3 major metrics to continuously improve cash flow, truly making a “game” out of it.

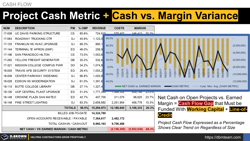

Project Cash Metric and Cash vs. Margin Variance

Contracting is a very capital-intensive business and it is critical to constantly be watching cash flow performance. This metric is the highest level of an “OUTCOME” for cash flow at the project level, summarizing the performance of ops and accounting.

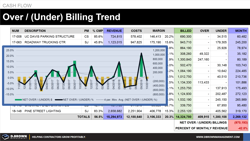

cash flow metricsOver and Under Billing Metric Trend

No amount of excellence in collections will help you get close to 100% if you are continuously under-billed on your Work-in-Progress (WIP) as a whole.

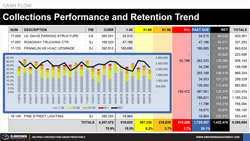

Collections and Retention Trend Metric

Assuming that a contractor’s project team has done an effective job of aggressively billing the project, the biggest variable that remains for cash flow is the effectiveness of collections.

Contractor Scoreboard: Key Results and Leading Activities (Disciplined Execution)

Defining what you want in quantifiable outcomes is extremely difficult. It's 10X harder to define those outcomes throughout the whole company from field to CEO. Defining the leading activities that create those outcomes is another 10X more difficult.

business management metricsLead Measures and Outcomes: Starting with the Schedule of Values (SOV)

It is nearly impossible for a contractor to have consistently great cash flow if they have a Schedule-of-Values (SOV) that isn’t loaded properly and integrated with the project schedule, including a projection of the cash flow.

Recap of the 4 Myths, 18 Tips, 5Cs, and 4 Metrics of Cash Flow

Cash flow is critical for the sustainable growth of a construction contractor and one of their key scoreboard metrics. Here's a recap of the 4 Myths, 18 Tips, 5Cs of Credit, and the 4 Metrics & Trends of Cash Flow.

Cash Flow: Key Reasons Why

Cash flow is one of the 7 basic objectives of a construction project team and one of the 7 drivers of contracting business valuation.