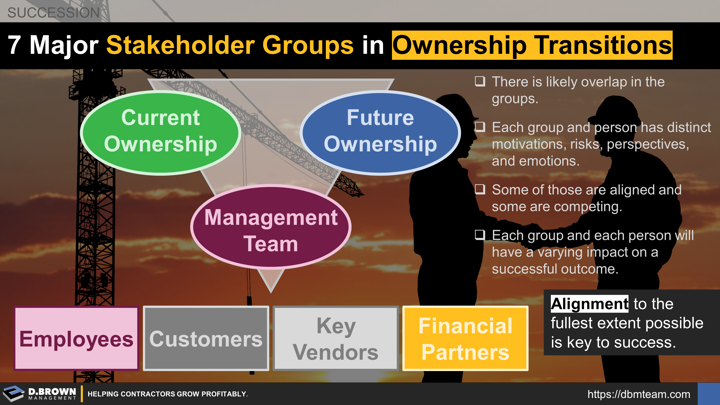

Each of these groups can have a varying degree of impact on the transition, some manageable and some that could tank the transition. Some of those impacts are positive, others are negative. The worst thing that could happen is if these impacts aren’t seen until after a deal is done, where significant amounts of capital are lost and careers damaged.

The three primary groups are:

- Current Owners: Needing a financial return for the business they have built, and possibly for helping finance the transaction.

- Future Owners: Needing a financial return for the capital they are putting at risk.

- Management Team: Ensuring the business continues to run well and needing a return on their professional time invested.

The four secondary groups are:

- Employees: Same as the management team. How many are a retention risk without the current owners and management team?

- Customers: Are the key customers tied to to the new structure via either the new owners or transitional management team? Will they follow the prior owners if they are not exiting the industry? Will they follow management team members that leave to competitors? How much will that impact the business?

- Vendors / Subs: Depending on how much of an advantage they provide the business in the market, they could be a risk to varying degrees.

- Financial Partners: Including banking, surety, and insurance. Depending on how much capital is involved, their history with the management team and future owners, this can shape the deal terms and constrain profitable future growth. It can also extend the time that current owners remain at risk.

There are most likely people who are in multiple groups. For instance, someone may be a current owner selling to a future owner, financing part of the transaction (financial partner), leasing the building to the business (key vendor), and staying on as part of the management team for a period of time. Though it is one person, their motivations, risks, perspectives, emotions, and deal terms that result from that should be worked through separately.

This is often incredibly difficult for founders of the business because for decades there was no need to separate these roles. Typically by the time a contractor has gone through an ownership transition 3+ times, the process and role clarity becomes more systematic.

An experienced and trusted but unbiased third party facilitator can be extremely helpful in creating clarity and alignment during the initial phase of succession and ownership transition.