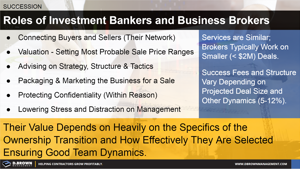

Roles of Investment Bankers and Business Brokers

Investment bankers can play a critical role, especially if the exit strategy is selling to a strategic buyer or merger with another contractor.

Private Equity and Construction

All of the trends that are changing the construction industry today require economies of scale and capital to truly take advantage of. Private Equity firms are seeing that trend and taking a bigger interest in the construction market.

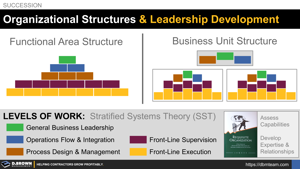

Organizational Structures and Leadership Development

As contractors look at their organizational structures with an eye toward both sustainable growth and succession, they must balance the efficiency a functional area structure provides with the leadership development of a business unit structure.

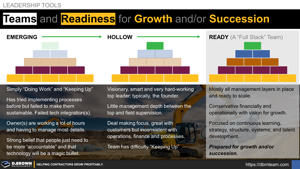

Teams and Readiness for Growth and/or Succession

Whether you are focused on growing profitably or preparing for an ownership transition, the strength of your team and organizational structure is a major factor.

Organizational Development OrgDev Succession Talent Value Stream (TVS)Ownership Transition - Key Buyer Risks

While different, buyers of a construction business have just as many risks as sellers. Deeply understanding the risks for both parties is a great start to creating the foundation of a deal.

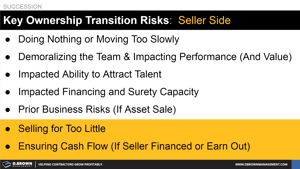

Ownership Transition - Key Seller Risks

Whether you are buying or selling a construction business, it is important to understand the perspectives of the other party. Each will tend to discount the risks of the other, impacting the ability to create the best deal.

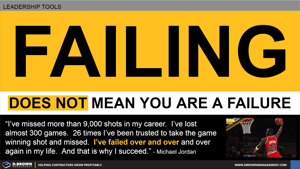

Michael Jordan and Failure

When it comes to our personal learning and coaching others, it is critical to stay in the “Learning Zone” as much as possible. Maximum benefit comes from pushing the outer limits of the learning zone into the panic zone where you will fail.

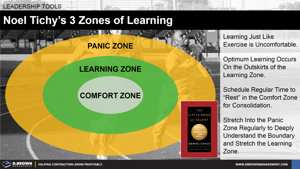

Noel Tichy and the 3 Zones of Learning

When it comes to developing talent in yourself and in others, it is important to know the boundaries of the learning zone as defined by Noel Tichy in his 3 Zones of Learning model.

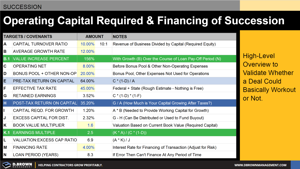

Ownership Transition and Capital Basic Model

When a contractor goes through an ownership transition, the business itself is the proverbial goose laying the golden egg. Remember the basic math formula for ownership transitions and use this simple calculator as a starting point.

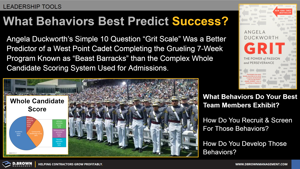

GRIT and Candidates at West Point

When you are looking at your organizational chart, job roles, and culture, what consistently demonstrated behaviors truly drive results?