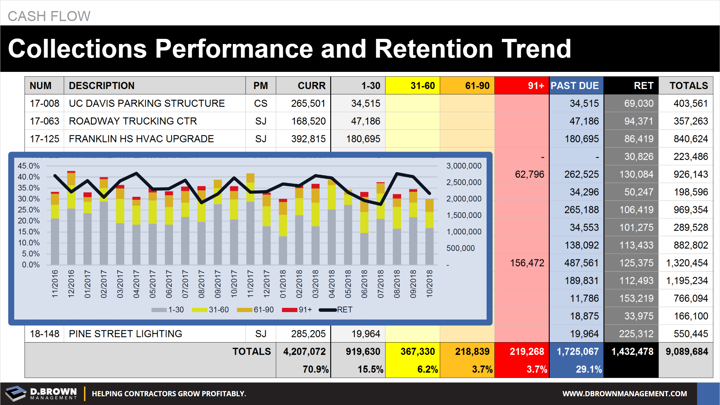

A good way to look at this is in your aging buckets as a percentage of the total outstanding, excluding retention.

You should see very little in the 91-plus day part of the bar chart, maybe a minor red tip at the worst.

You should see a trend of the total percentage of your receivables that are 1-30 days or more past due coming down. We have seen contractors get these below 10% with rigorous attention to the collection process.

The other trend to look at on this same graph is your retention outstanding. It is very easy for a contractor to get into growth mode and only taking on longer-term projects to have all their cash held in retention.

Retention outstanding can be dramatically reduced by:

- Negotiating lower retention, retention on labor only, phased retention releases, etc. at the contract level.

- Building strong relationships that allow you to ask for reductions in retention throughout the project.

- Effective close-out to ensure there is no reason to hold retention.