As we have been working with contractors and helping them navigate COVID, we have been studying their various responses to the Great Recession in 2007-2008, including their varying conditions going into that recession.

By deeply studying their market, team, strategies, tactics, and results from 2007 through 2015, we have been able to prepare an executive briefing and facilitate planning sessions to help them navigate the current climate while setting the stage for them to dominate in the next few years.

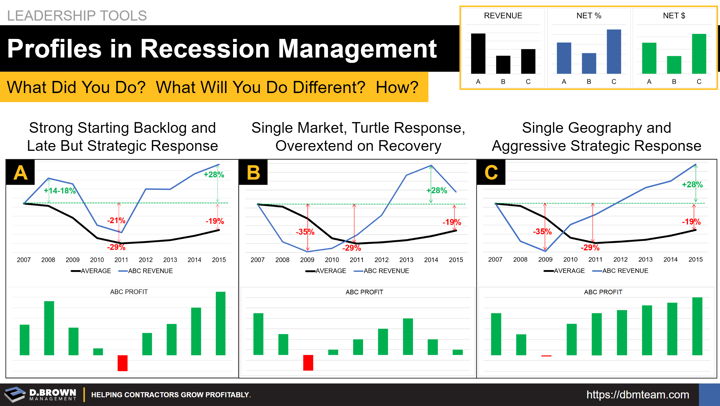

While there are many more nuances to each contractor, most typically fall into these three patterns:

- Started with a strong backlog of work, either due to being in markets that had a typical lag in funding cycles or due to having long-term contracts in place. Because of this backlog, they didn't respond aggressively in the first couple of years and still experienced growth in both revenue and profits while many of their competitors struggled. This reinforced a feeling of invincibility in the team and made them slow to react to the downturn, pushing their dip forward 2-3 years from the start of the recession. Due to the underlying strength and experience of the team, once they clearly saw the problem, they responded forcefully and made difficult cuts combined with aggressive strategic investments into new markets and business development.

- Heavily focused on a single market or geography going into the recession, making them susceptible to a near-immediate decline in their work. The profile of work that can be shut down almost immediately includes shorter cycle projects and customers or markets who have construction funding cycles tied directly to their short-term business performance. Examples of this typically include retail, housing, hospitality, and general purpose commercial space. Making this immediate drop in revenue worse is management that makes reactive cuts to overhead and pricing, essentially racing the market to the bottom and then some. Upon recovery--because they had cut capacity and were more reactive in response--they tended to overextend. While having immediate spikes in revenue upon recovery, it wasn't sustainable and profitability dropped. Stress levels on their teams also spiked and turnover increased. This is all part of the typical business growth cycle.

- A combination of B+A: going into the recession heavily invested in a single market caused that same immediate drop in revenue. However, having leadership that is focused on the long-term by taking deliberate but aggressive action meant they were able to avoid taking on losses while also making strategic investments in market expansion, people, and capabilities. This set them up for consistent growth in revenue and profitability through the recession, leaving them well-positioned for the future.

Top-line is vanity and bottom-line is sanity. In looking at the average net profit dollars when leveling out for size differences, there was a 2X difference in outcomes between these typical response profiles with only a 15% difference in revenue between 2007-2015.

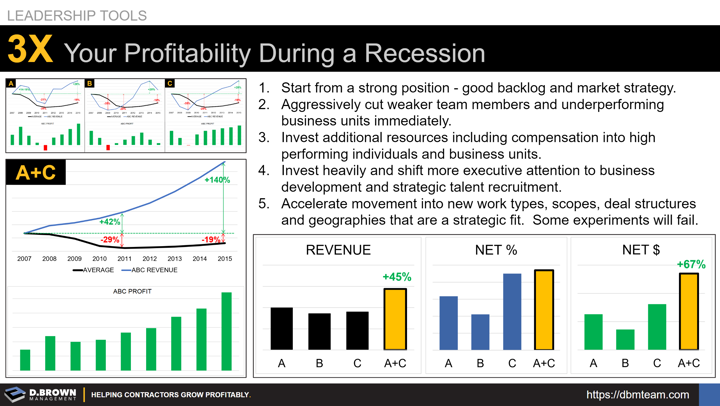

The worst combination is B+A, where the contractor was focused in a single market declining quickly, but then didn't react quickly, therefore taking major hits to their revenue, profitability, equity, and team. Often they never recover from this.

The best possible combination is A+C where the contractor goes into the recession with a pretty strong foundation and still takes very aggressive action. This will lead to 3X increase in profitability and 50% additional capacity to serve customers.

- Start from a strong position - good backlog and market strategy.

- Immediately cut weaker team members and under performing business units.

- Invest additional resources, including compensation, into high-performing individuals and business units.

- Invest heavily and shift more executive attention to business development and strategic talent recruitment.

- Accelerate movement into new work types, scopes, deal structures, and geographies that are a strategic fit. Some experiments will fail.

- What did your business do during the last recession?

- How would you evaluate your business against these five criteria right now?

This is one of those situations where an unbiased but experienced third-party facilitator can add significant value. Learn more.

Contact us to schedule a meeting to discuss the specifics of your business and see if there is a fit. We guarantee you will gain significant value just from this initial discussion.