Jim Collins popularized the principle of "Who Before What" in Good to Great and subsequent books.

We have never seen an unsuccessful contractor that applied this principle to three groups of people:

- Internal team

- Customers

- Vendors & Subcontractors

Application of this principle in business, careers, and life is rarely easy but always worth it creating wealth on all dimensions.

There are a lot more details to your market strategy, business model, 3-year plan, business development, and talent pipeline required to build a contracting business.

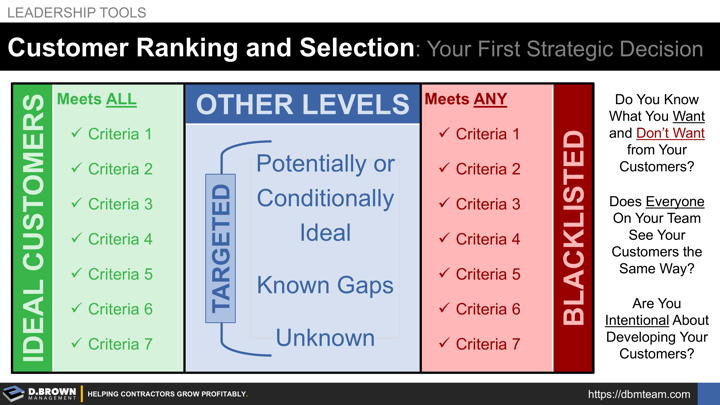

This article is only focused on defining the bookends to your range of customers - Ideal and Blacklisted, along with a few recommended in-between categories.

Why Go Through This Work?

To answer this question, it's important to start with all the reasons why it's may not seem that important to define. Some of the more common reasons include:

- Customers are hard to come by - we need them all.

- We already know who our good customers are.

- Coping with less-than-ideal customers is just part of the business.

All those are true. And all those reasons must change for growth to be successful. If you find yourself experiencing any of these eight indicators, one of the causes is very likely customers. The reasons to go through this work include:

- For profitable growth and succession readiness, it is important for all managers to see customers the same. This situational awareness starts with seeing the different details about customers from different perspectives. The next step is standardizing on the vocabulary and definitions beyond the generalized "good" or "bad" vocabulary frequently used.

- Business development fact 2 out of 4 is that you likely don't even know who a fraction of your potential customers are. Hurdle 3 of 9 for the business development function is having those relationships identified. If you aren't clear on what you are looking for, you won't be as effective in your research, networking, information gathering, and relationship building.

- Having clarity on customer ranking including how much of your revenue, gross margin, cash flow, and opportunity pipeline is coming from each category of customer ranking will improve your business planning and opportunity selection process.

Defining Your Book Ends (Ideal & Blacklisted)

Once you have these defined, you will be able to fill in the middle categories pretty easily.

Define a small group of people to answer these questions. Make sure they are looking at the customer relationship from a range of perspectives including preconstruction, estimating, project management, field management, accounting, and admin. This group of people will range from 3 people at a 25-person contractor and 8-10 people at a 150-person contractor.

Give each person time to reflect on their answers including studying past project information so you avoid group think or rapid emotional responses. Typical time to prepare 3-10 business days before meeting to discuss answers.

- What are the Top 3 Factors that define an Ideal Customer?

- Please provide the 3 Best Examples of customers that fit most or all of these Ideal criteria. Please limit your list to those that you have had experience with in the last three years. Please include your reasons why including anecdotal stories and metrics where applicable.

- What are the Top 3 Factors that define a Blacklisted Customer? This is a customer we would prefer to never work for unless there were zero other options available.

- Please provide the 3 Best Examples of customers that fit any of the Blacklisted criteria. Please limit your list to those that you have had experience with in the last three years. Please include your reasons why including anecdotal stories and metrics where applicable.

Bring the team together and start building a consolidated list starting with the Ideal Customer criteria.

Work to turn generalities into more specific and measurable criteria where possible. The examples will help tease out these specifics, especially if different people see the same customer differently.

Work through the list until it is prioritized to the Top 5-8 specific criteria that define each. Include examples of customers representing each list. Recommend getting a draft in one meeting, then giving everyone a few days to reflect and finalize.

Ranking Categories Between Book Ends

These will vary by contractor but can include:

- Potentially Ideal: Based on everything you know, there is a high probability they will meet all the Ideal Customer criteria within the next three years.

- Conditionally Ideal: Within a narrower scope such as project type, project size, or when they use a certain project team, they meet all the Ideal Customer criteria.

- Known Gaps: You know where, when, and how they fall short of the Ideal Customer criteria. You have clarity on how to mitigate starting with pricing and terms.

- Unknown: No recent first-hand experience or reliable market intelligence about them. You know who they are and are in the process of developing a relationship then gathering information about them.

For any customer that fits into these categories, have clarity on the reasons why so you can adjust.

Targeted Customers / Potential Customers

"Targeted" defines a select group where 80% of leadership time with customers and potential customers must be spent proactively.

Too frequently, the majority of leadership time with customers is spent fighting fires.

- All Ideal Customers are Targeted

- Targeted also likely includes customers and potential customers in other categories that will have the biggest influence on achieving the 3-Year Business Plan.

Targeted is not a separate category but rather an additional flag for prioritization of resources including executive time. This list is short by design.

Everyone on the team must be aware of this list of targeted customers and what their role is in ensuring they receive the right level of attention.

Check Your Criteria, Ranking, and Targeting

This is the most important part of the process. Pull together a comprehensive list of customers and potential customers from three sources:

- Every customer you have done work with in the last 3 years.

- Every customer / potential customer you have pursued an opportunity with in the last 3 years (bid, proposal, SOQ, etc.)

- Every customer / potential customer you have been working on through your business development activities in the last 3 years.

There will be overlaps between these three lists. Consolidate them into a single list with some basic information including:

- Projects during the last 3 years. (Quantity, Revenue, Margin)

- Bids / proposals during the last 3 years. (Quantity, Revenue, Won, Lost)

Optionally, you may want to include geography(s) and market sector(s) they serve depending on their size and yours at the time.

- Sort the list starting with margin.

- Talk through them based on your criteria and assign a ranking category.

- Explore the areas where people see the same company differently.

- Make notes about what information you need to gather if you are missing information.

- Make notes about how to help them improve and how to mitigate known gaps.

- Adjust your criteria and ranking categories along the way.

To maintain focus, do these in blocks of about ten at a time. This can usually be tacked on to an existing meeting (project reviews, project startup, billing & collections, opportunity review, etc.). Within a relatively short period of time, you will have clarity on your customers. This is the foundation for improvement.