Strategic Decisions are the highest-leveraged work done by the owners and leaders of construction businesses. The decisions must be supported by execution but it all starts with making hard choices.

The Five Interlinked Questions about Strategy that Roger Martin describes for making choices that will best position a construction business to win over the long-term must be asked and answered at multiple levels in the company.

- They must be asked and answered when reviewing opportunities to decide whether it's a "Go" or "No-Go" to pursue further.

- They must be asked and answered when developing a customer relationship.

- They must be asked and answered when pursuing a specific project all the way through the start of the project, the execution, and exit.

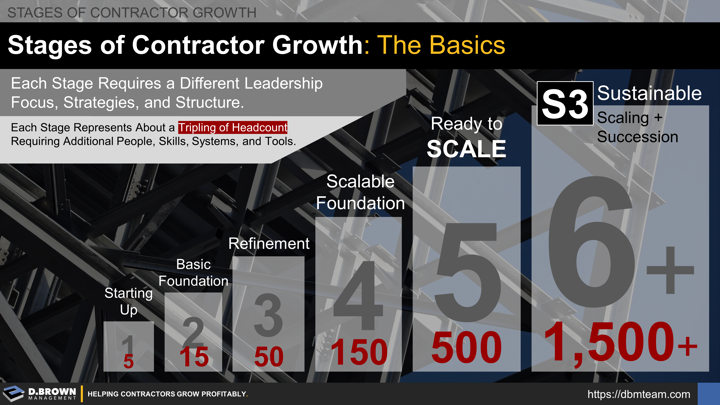

These questions change dramatically with each stage of contractor growth in terms of:

- Complexity of the questions being asked.

- The information from both inside and outside the company being used as a basis for the questions, discussion, and decisions.

- Discipline in the answers - especially when choosing what to say "NO" to. (5D Facilitation)

- Who is asking, who is involved in answering, and who is deciding them at different levels. (Stratified Systems Theory - SST)

- How are they asked and answered (process, procedures, and tools).

- The degree to which they are integrated throughout all parts of the company, creating synergies that deliver outcomes way beyond the sum of the individual parts.

As an example, a Stage 1 contractor's strategic decisions are relatively simple:

- What kind of work am I pretty sure I can build?

- What's the biggest project I can afford to build given limited cash, people, tools, and equipment?

- Who will take a chance on me? Note that this question likely refers to decisions about customers, suppliers, and employees at this stage of growth.

By Stage 3, a contractor should already be making some decisions about types of work and customers that they can no longer do effectively while also finding some niches in the market where they are building true competitive advantages.

As a contractor moves into Stage 5, the choices about what not to do get much more difficult:

- The company is performing well so new markets seem daunting because they would have to grow significantly to make a material impact on the bottom-line.

- Some markets, customers, and project types that were instrumental in growth through the last few stages may be leveling out in their growth.

- Some of the choices for what not to do may now measure in millions, making it easy to rationalize why exceptions to the strategic decisions should be made.

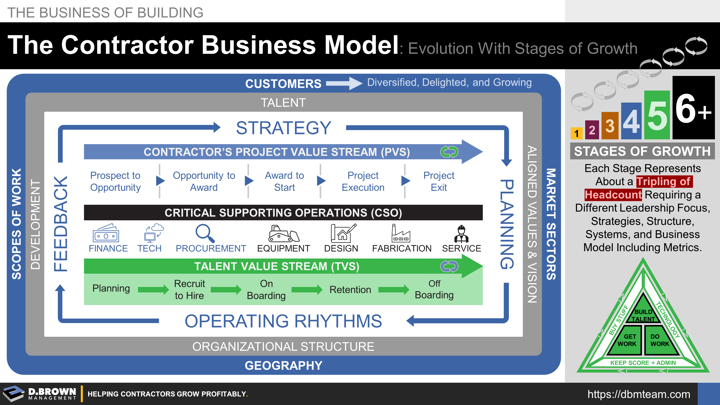

- Strategies around Operational Excellence (Project Value Stream and Critical Supporting Operations) must be integrated with the company and market strategies, but this integration is messy, taking time and consistent deliberate effort.

- Talent is being thought of systematically with strategies and systems to support Organizational Development, but that integration is even messier. This is the Talent Value Stream.

As a contractor moves into Stages 6+, you start to see a fully integrated model of strategy, planning, execution, and feedback develop as a routine system.

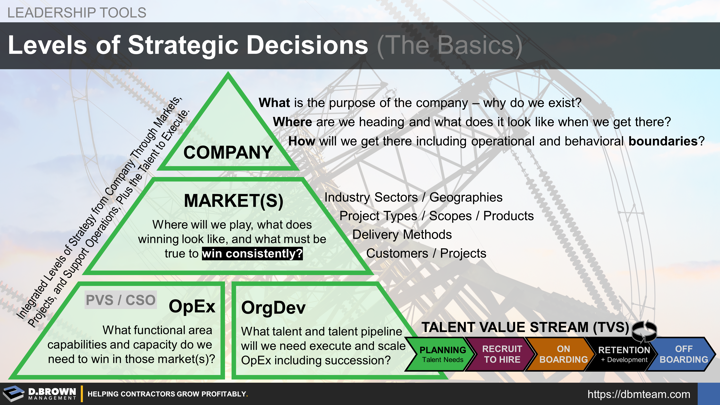

The broad questions at each level are:

COMPANY

- What is the purpose of the company? Why do we exist?

- Where are we heading and what does it look like when we get there?

- How will we get there, including operational and behavioral boundaries?

MARKET(S):

- Where will we play, what does winning look like, and what must be true to win consistently?

- Where won't we play?

These questions must be asked and answered at several levels within the broader definition of "Markets," including the following:

- Industry Sectors

- Geographies

- Project Types

- Scopes of Work

- Products (if applicable - some contractors also manufacture things)

- Delivery Methods (Design-Build, CM-at-Risk, etc.)

- Customers

- Projects

OPERATIONAL EXCELLENCE (OpEx): What functional area capabilities and capacity do we need to win in those market(s)?

- Project Value Stream (PVS)

- Critical Supporting Operations (CSO)

ORGANIZATIONAL DEVELOPMENT (OrgDev): What talent and talent pipeline will we need to execute and scale OpEx, including succession?

- Talent Value Stream (TVS)

These questions grow or shrink in complexity depending on a contractor's stage of growth tailored to the business model that is appropriate for their stage of growth and trajectory.

This article, at best, scratches the surface of strategy, planning, and execution for a contractor. It was only meant to cover the basics.

When it comes to making good strategic decisions about a business, this is one area where an experienced but unbiased 3rd party can add significant value in a couple of ways:

- Formulating and asking questions to you and your team tailored to where you are currently at in your stage of growth, trajectory, capabilities, capacity, aptitude, and desire.

- Bringing in outside information and learning resources to prepare you and your team for the next stage of growth and/or help you make the strategic decisions.

Just as your strategy will evolve over time, so will the people you involve for helping with the process.

Sometimes we are the right fit. Sometimes we are not. In any case, we exist to help contractors build stronger businesses for the next generation so we will share freely anything we have learned. This includes whether we could be a good fit, or if we know someone else who would be a better fit, or if you really don't need any outside help with this beyond a phone call or two.

All relationships begin with a simple conversation. Please contact us to schedule some time to confidentially discuss your situation.