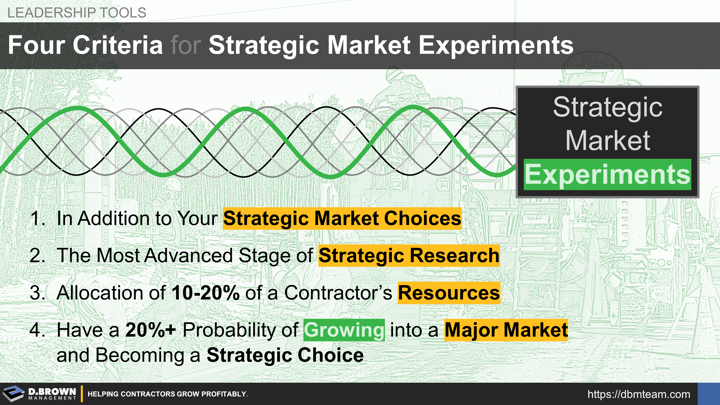

These Strategic Market Experiments must be intentional and not just emerge based on individual preferences throughout the company. They are part of your Strategic Decisions and one of the Six Phases of the Strategy and Planning Process with four basic criteria:

- They are in addition to your Strategic Market Choices - the major markets that are both your current and future engines for growth and cash flow.

- They are the most advanced stage of Strategic Research where the market looks promising as compared to other market possibilities and warrants further investment.

- As a whole, all Strategic Market Experiments represent 10-20% of your most critical resources, including capital and key talent. Remember that the talent required to scale a major market is typically very different than the talent required to learn and develop a new market for a company.

- Each Strategic Market Experiment should have a 20%+ probability of being able to grow into a major market and become a Strategic Choice. The evaluation and routine check-in process should provide clear criteria for when to invest, when to exit, and when to make the management changes required to operate, scale, and refine that market.

An experiment may be to perform the same work in a different geography, a scope of work that is related to work you currently do, manufacturing of parts or whole assemblies that you currently buy, or something totally different. This is all defined in the Strategic Research stage and decided upon by leadership.

The biggest challenges we typically see are:

- Exiting markets and customers that no longer fit the strategy while re-allocating resources and people to other markets. There is a lot of organizational momentum including relationships and comfort in what used to be. The talent and especially the leadership in these areas will typically run through a wide range of emotions from feelings of failure to sadness to resentment around the choice.

- Exiting market experiments where the market proves not to be viable at this time. The same challenges with exiting a market.

- Making the changes in management, systems, and structure required to move from a successful experiment to a major market. Different stages of growth require different strengths in people.

- Rationalizing individual preferences and relationships under the umbrella of strategy.

We have never seen these changes come easily. The best we've seen is when leaders balance decisiveness with compassion and communication. Over time, this creates a culture where people grow more comfortable of their unique value-add to the team and don't tie that to a particular role or market.