Growth eats cash and just a few hiccups in execution can put just about any contractor in a very bad position.

Regardless of how much capital you have or how great your cash flow is currently it is critical to build a culture of managing your cash as if you were counting pennies to make payroll each week.

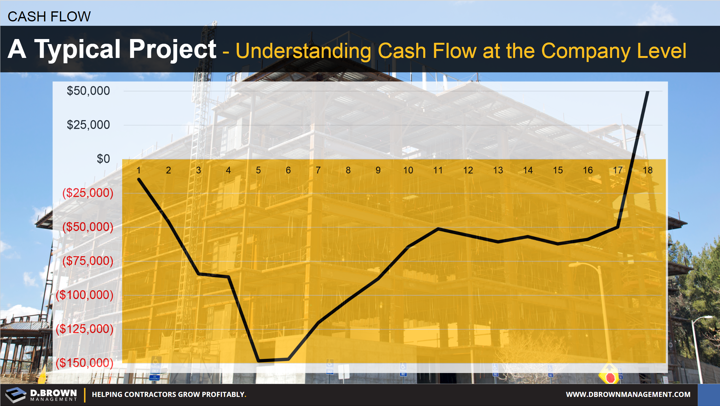

The basic cash flow graph at the company level assumes the following:

- $1M project, 15% gross margin and 16 month construction schedule with 10% company overhead.

- Labor paid weekly and vendors paid within 30 days of delivery. No special terms.

- No front-loading of the Schedule of Values (SOV) or monthly billings but also no under billings.

- Payments within 30 days of billings.

- 10% retention billed for upon completion and paid the month following the last billing.

As you can see a contractor has to leverage quite a bit of capital and their operating Line of Credit (LOC) to operate the business.

There are about a dozen little tricks that project teams can use to accelerate cash flow substantially.

We are going to be making our cash flow workshop publicly available in the coming months.