Previously we looked at a typical construction project’s profitability basics and then covered a brief description of cash flow. Now let’s get into the basics of how that looks over the course of the project.

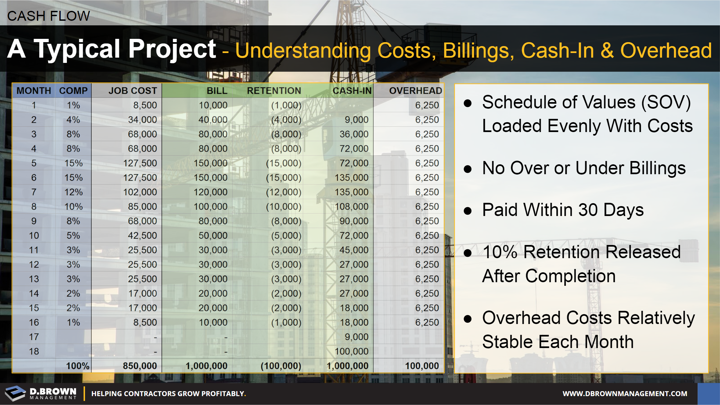

- In our example the project is 16 months in duration.

- The completion of the project during each month is an average of several real projects. This will vary significantly based on each project and it is important to understand those variances.

- Costs per month are shown to be paid during that period. This also varies significantly based on the project type. For instance labor is paid immediately each week where most subcontractors are “Pay-When-Paid” including retention. This is why a labor-intensive specialty contractor must have higher profit margins than a general contractor that does not self-perform.

- Bills are paid in the month following. For many contractors this is closer to 2 months on average which changes the cash flow dynamics significantly.

- Retention of 10% is held out of each billing. It is billed for after completion of the project then paid a month after that. Again this is very generous as compared to how it works most of the time.

- Billings match earned revenue perfectly. There are no “Under Billings” or “Over Billings” shown in the model just for simplicity.

- Overhead costs are spread evenly across the whole project duration. There are many ways to look at this but in general overhead costs don’t vary much each month.