Sun Tzu and The Art of War has many principles, insights, and strategies that a construction contractor can learn from. Where military leadership and conflicts differ from construction is that contractors are all seeking to serve the same customer.

This is why leaders of construction contractors should spend 90% of their time on how to best add value to their customers and their customer's customers including understanding the Extended Project Value Stream (PVS) from their perspective.

FOUR REASONS TO UNDERSTAND YOUR COMPETITION

- Learn what matters from your customer's perspective based on their words and actions toward your competition.

- Build relationships that can be leveraged for both future potential recruits and cooperation (#4).

- Gain insight into the best ways you can price and position your business against them whether it is on projects or for talent.

- Identify ways to eliminate the good competitors by working together including Joint Ventures (JV), splitting up scopes, subcontracting arrangements, mergers, or acquisitions.

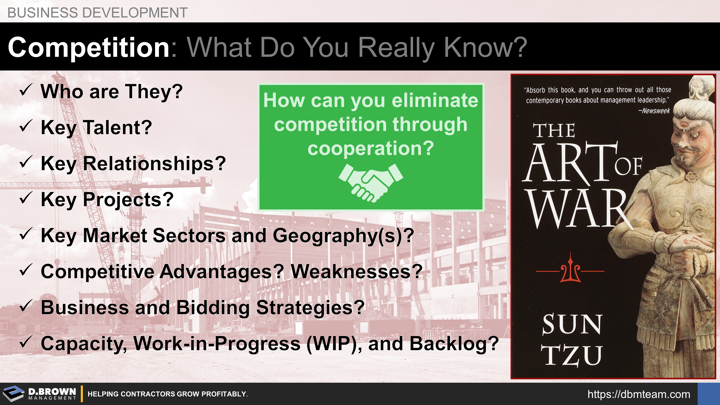

EIGHT THINGS TO KNOW ABOUT COMPETITION

- Who Are They: Who are the contractors you run into regularly? Who works just outside your geographical area(s) that could easily expand into your area? Who performs closely related scopes that could expand? Who serves your customers in other geography(s) that may look to expand?

- Key Talent: Who are the players on their team from PM/Estimator/Superintendent levels through Owners? What is your relationship with them?

- Key Relationships: Looking at the Extended Project Value Stream, who do they have good relationships with? Bad relationships? Why?

- Key Projects: What demonstrates their capabilities and what will they present for references? Include good and bad if applicable.

- Key Market Sectors and Geography(s) Served?

- Competitive Advantages? Weaknesses? A combination of what they say, what you see, what your customers say, and what your customers do are four angles to look at this from.

- Business and Bidding Strategies? Growth, risk, returns, succession, etc. are all important factors to know the basics of. Every contractor weighs these differently and they change over time.

- Capacity, Work-in-Progress (WIP), and Backlog? Combined with #7, this can help you refine your own pricing, presentation, and negotiation with customers. It can also help lead into discussions about cooperation (see above).

REMINDERS & TIPS

Don't underestimate your competition. It's easy to dismiss them as being "dumb."

Don't overestimate your competition. It's easy to choose to not compete.

Don't get in a street fight over projects or people - this is usually a race to the bottom. Even the best fighters in the world will tell you to avoid street fights because crazy, luck, or crazy-luck can cause you serious harm.

Respect "Good Competition" as any more than a 25-30% market share should be the target for any contractor to maintain margins and minimize risk.

Advanced Tip: Eliminate "Good Competition" through cooperation where possible including Joint Ventures (JV), splitting up scopes, subcontracting arrangements, mergers, or acquisitions.