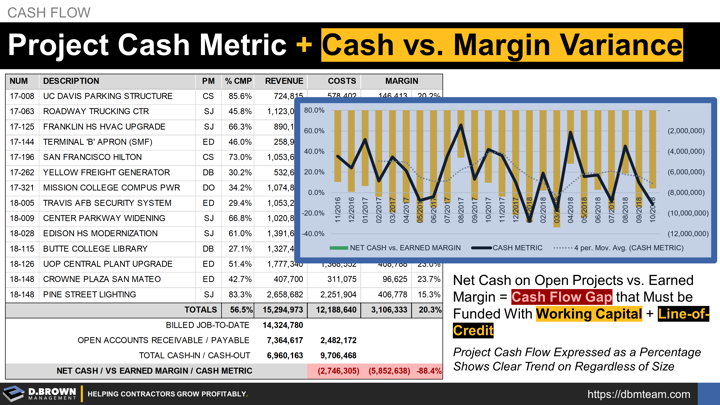

This metric is the highest level of an “OUTCOME” for cash flow at the project level. It summarizes the performance results of the 18 cash flow tips and provides a great dashboard for integrating operations and accounting.

- Start with a Job-to-Date (JTD) summary of your open projects on your Work-in-Progress (WIP), defining “open” as any project that has remaining costs or outstanding billings to collect.

- Look at JTD Billed from the WIP and your Open Accounts Receivable Aging report to get the net “Cash-In.”

- Look at JTD Costs from the WIP and Open Accounts Payable Aging report to get the net “Cash-Out.”

- Cash-In minus Cash-Out = Net Cash

- JTD Earned Margin - Net Cash = Cash Margin Variance which is the gap that must be covered by a combination of your working capital and your Line-of-Credit (LOC) and is the amount of “financing” you are providing your customers.

- Net Cash / JTD Earned Margin is a percentage that you can graph over time to see a trend in your cash flow management regardless of your monthly volume. Below 100% is the degree to which you are providing financing to your customers. This can also be expressed as a decimal (0.8, 1.1, etc.) as shown on the Contractor Scoreboard.

It should be noted that the foundation for great cash flow performance starts with the selection of the best opportunities to pursue then negotiating terms that enable great cash flow.