Capital is one of the three basic constraints a contractor must navigate, along with the industry-wide shortage of talent (macro view) and the available work within the market area(s) they choose to play.

Of all the categories of Capital-at-Risk that a contractor has, working capital is the biggest constraint but also the one that can be improved the most.

Definition: Working Capital = Current Assets less Current Liabilities

Caution: If you are yet not using a Work-in-Progress (WIP) schedule, which may be typical for contractors in their first few stages of growth, or if your WIP is inaccurate, your calculation of working capital will be misleading. Contact us to discuss some quick ways to get to an accurate working capital number.

No Risk = No Returns = No Opportunity

All returns must be weighed against risk.

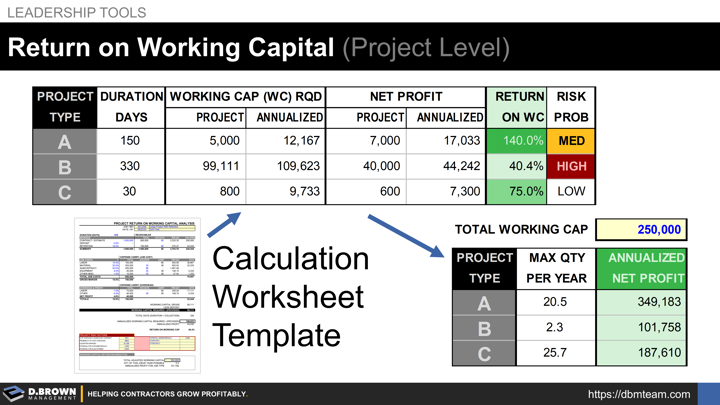

Looking at the project profiles above, you can see three dramatically different returns for the working capital utilized. Below, we'll detail how to calculate this, including providing a worksheet.

When selecting the right opportunities to pursue, your return on working capital must be considered in evaluating operational alignment.

- Your strategic market choices and target customer criteria play a significant role in improving your return on working capital.

- Your operational execution—starting with contractual terms through to Schedule of Values (SOV), changes, billings, and collections—is the other big variable.

Contact Us for the Worksheet Below, Including Ideas on How to Best Use it in Your Business. We will walk through the basics here, but there are many nuances unique to each construction business that must be tailored for your specific situation.

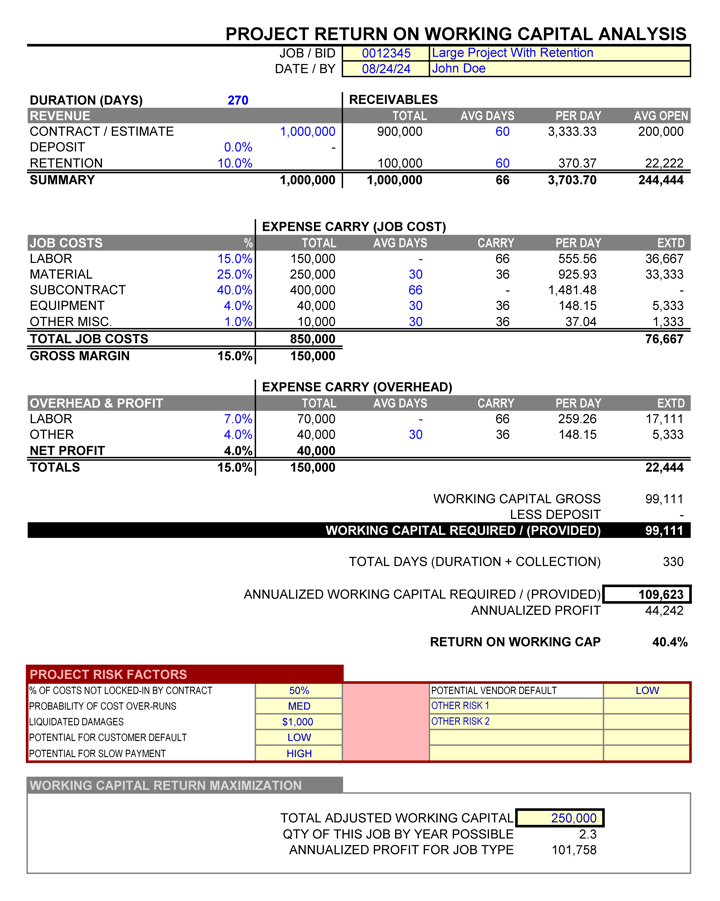

DURATION, REVENUE, BILLINGS, RETENTION, and PAYMENT

The top section provides basic job information, including estimated duration, which impacts how long your retention is tied up and estimated payment cycles. Keep in mind that this is only for averages to give you a number for comparison. You could add in additional details, such as your ability to be over-billed ,which would have the effect of lowering your average days. For example, if you are consistently 20% over-billed and still getting paid in 60 days, your effective average drops to 48 days.

EXPENSE CARRY (JOB COSTS)

Depending on your mix of job costs and payment terms, you can fill in this section. The payment terms for these costs are compared against the average payment (above) to give you an estimate of the costs you will be carrying per day, and for how many days.

Note the dramatic difference between labor which must be paid out immediately while waiting on payment as compared to subcontracted work that is typically pay-when-paid. Consider what it would look like if your vendors offered the same pricing but with 60-day terms. Consider what it looks like if you choose to take advantage of vendor early payment terms and saved 2%. These are all variables that you can create standard processes and management systems around.

EXPENSE CARRY (OVERHEAD)

Repeat the process above for your overhead.

SUMMARIES

- Estimate the working capital required to fund this project. Note that this can be a combination of your working capital and available operating Line-of-Credit (LOC). This worksheet is just for comparison of different projects to select those offering the best risk-weighted returns.

- Annualized working capital and annualized pre-tax net profitability are based on executing similar projects, which is a function of the duration plus collection times.

- Return on working capital takes a look at the annualized profitability for this job and compares it to your total working capital which is a finite resource.

PROJECT RISK FACTORS

This section must be tailored to your business, market(s) you work in, and scope(s) you perform. Returns by themselves are meaningless if you don't evaluate the risks. This is where you want to weigh out 10-15 of the biggest risks you will face on projects and get the whole team good at evaluating them including:

- Percentage of costs not locked-in by contract or quote.

- Probability of cost overruns - which may be separated into production rates, schedule overruns, and scope gaps.

- Liquidated damages.

- Risk for potential customer default.

- Potential for slow payment.

- Potential for slow processing of changes.

- Potential vendor default.

This is only an example - you will want to expand and clarify this for your team. It is just part of the project evaluation criteria.

WORKING CAPITAL MAXIMIZATION

This final section reviews your total available working capital and estimates how many of this type of project you could perform concurrently each year, along with the annualized profit for this job type. You can see how this would flow into comparison we started with above evaluating three different opportunities.

Remember that where there is no risk there is also likely no reward.

Also remember that The Business of Building is about working to maximize returns while minimizing risks. Tools like this help you see opportunities to improve starting with the opportunities you choose to pursue.

Please contact us for a copy of this worksheet and to discuss how we've seen contractors use it to dramatically improve their operations.