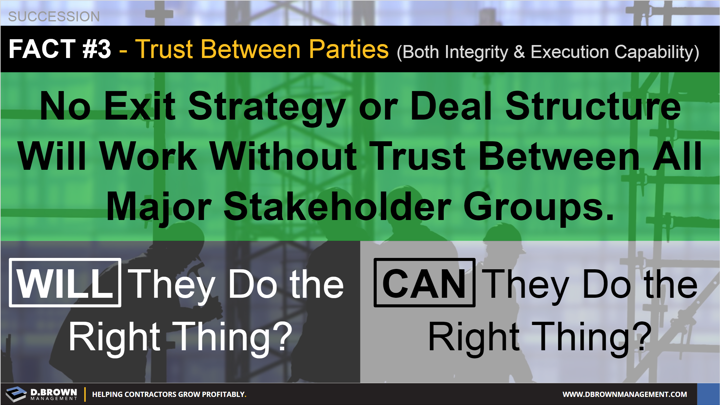

Whether it is a large and complex project or a business ownership transition, there will never be a “perfect” set of documents or plan. Like building a successful project, what allows great teams to work through these issues is open communication built on a foundation of trust between all parties.

Divide trust in two categories knowing that both are required:

- Trusting of integrity and intent. Take 15 minutes to watch Brené Brown’s video on The Anatomy of Trust with a notepad in hand and a list of each of the major stakeholders who are involved in an ownership transition. Who do you trust? Who don’t you trust? Why? How will that impact a deal?

- Trusting of someone’s ability to execute. This is about competencies and no deal structure will create these capabilities. Who do you trust to execute? What are the boundaries of this trust? What can be done to extend these boundaries? How will these answers impact a deal?

Get specific in your answers to where they are actionable.

Have others go through the same exercise and openly compare notes. If that makes you uncomfortable, then you might want to very closely examine the level of trust you have between parties with the knowledge that doing so will have an impact on an ownership transition.