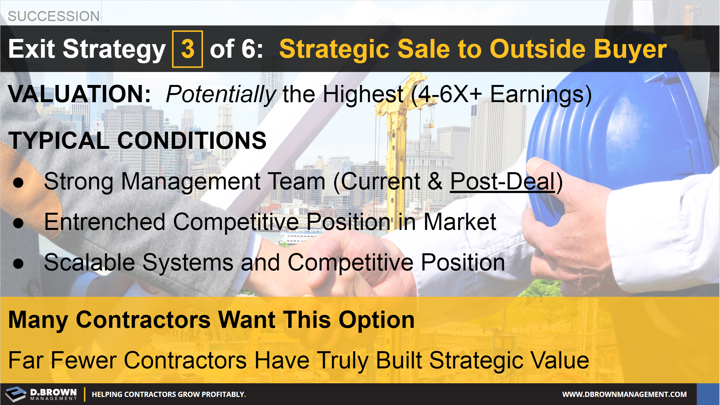

Specifically, an outside buyer that sees such a strong strategic fit with their business that they are excited to pay a 6X earnings multiple of the best performing year the contractor has had during the last three years in cash.

Fact: Most media coverage of deals is either a strategic sale or a catastrophic liquidation through bankruptcy. This can skew a contractor’s view of the market.

Fact: Only a small percentage of ownership transitions could be considered strategic sales with high valuation multiples.

Fact: The only way a high valuation makes sense for the buyer is if the contractor has either a competitive position, technology, or process that can be scaled up significantly with access to more capital or other operational assets the buyer has. The ROI (Return-on-Investment) still must pencil out for the buyer.

Fact: Few contractors have truly built highly scalable competitive advantages that make this type of exit an option.

Fact: If you have truly built scalable competitive advantages that require more capital to execute then an outside strategic buyer is your only option.