This is meant to be a basic guideline. Every contracting business, along with the conditions they operate in, is a bit different. Each owner thinks differently about risk, and risk evolves with each stage of growth. The main purpose here is to develop a common understanding, vocabulary, policies, and tools that will help you optimize your return on the capital you have at risk.

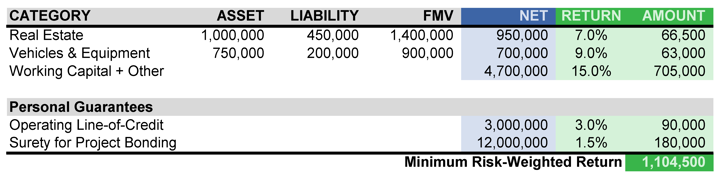

This is especially important during growth, when changing market strategies, acquiring a company, or during ownership transitions. The objective is to arrive at a simple summary like the following, that can serve as a basis for everything from contract negotiations to minimum thresholds for bonus programs to capital management policies.

Please contact us to discuss any of the guidelines outlined below as they apply to your situation.

The Basic Categories

Each category below has different risk factors associated with it. Depending on the conditions in which the business is operating in, these risk factors should provide a minimum return for the person(s) taking that risk. Review the list below and think about your own business.

- Real Estate (Owner Occupied): If applicable to your business, this is generally the least risky of the capital a contractor has at risk. Not only is it required for the daily operations of the business, but it also has a clear market value and can be leased or sold. When evaluating the degree that the real estate is at risk, you need a Fair Market Value (FMV) number which is likely very different from what is on your balance sheet and should include any improvements you may have made to the property. An evaluation of a fair return for this risk can be found in the current mortgage rates for a similar property. If you have a loan associated with it, you'll want to use the net of the FMV and loan balance for calculating your capital-at-risk. Highlight the associated items on your balance sheet for this so you don't double-count anything.

- Construction Equipment & Vehicles: Nearly every construction business will have at least a few vehicles. Civil contractors may have 1/3 or more of their total balance sheet tied up in their fleet. Again, adjust for FMV to get a total asset value then subtracting out any current loan balances associated with the fleet to get your capital-at-risk number. A good benchmark for estimating return begins with what your bank will provide for financing. Be aware that manufacturer financing is typically distorted and used as a sales mechanism, so it should not be relied upon. Depending on your fleet, you may want to assign several different rates - for instance, some equipment is much more specialized, so it requires a higher return for the investment while things like a standard truck have very standard market rates for risk.

- Working Capital + Other: This is the remainder of your balance sheet. It will represent the majority of your capital at risk, and many factors go into calculating a reasonable return on that risk. We will discuss those factors more below. It is recommended that you adjust this number for details like questionable accounts receivable, inventory with little market value, related-party loans, intangible assets such as goodwill, and so on. Aim to understand what capital you really have tied up in the business and at risk.

- Personal Guarantees: A longer-term objective should be to eliminate personal guarantees on the business. If you are not yet in that position, you need to identify all your personal guarantees and evaluate their associated risks to determine an appropriate return, as seen in the example above. Keep in mind that the personal guarantees cover risks beyond the categories listed above, so reducing those risks—especially in working capital—will also lower the risks tied to your personal guarantees. Additionally, consider your personal net worth outside the business. The greater it is, the more you will expect in return for putting it at risk.

Grab your balance sheet and start filling in a spreadsheet like the one above. You'll be surprised at what you learn.

Risk Considerations for Working Capital + Other

- How profitable is your business as compared to industry benchmarks for similar businesses?

- How consistent have those profits been over the last three full years and current year-to-date (YTD)?

- How consistent is your project turnout as compared to what you expected to make in your estimate? Look at your Work-in-Progress (WIP) projections.

- How much cash does your WIP burn or generate? What has the trend been over the last 36 months?

- How secure are your receivables, considering customer concentration, your lien rights, and whether you are in a state with pay-if-paid laws?

- How does your Working Capital (Current Assets - Current Liabilities) as a percentage of your Revenue compare to industry benchmarks for similar businesses? Being undercapitalized means additional risks.

- How does your Debt (Total Liabilities) to Equity ratio compare? Higher than average debt equals more risk.

- What has your growth trajectory been, and why? What does it look like going forward? Very rapid growth or decline could both represent higher risks.

- Do you have key positions retiring that will increase risks?

- Are you going through any major changes with customers and/or market strategy that will introduce risks including geographic expansion?

A general baseline for the return on working capital should be at least 2X the return for equipment for a contractor that is running consistently well. Adjust upwards based on these risk factors.

Please contact us to discuss your specific situation. We will share freely anything we know that will help contractors build stronger businesses. We've had initial discovery meetings where some of these questions were discussed with owners being able to get out of personal guarantees based on a few small tweaks. That isn't a guarantee - just something we've had happen.