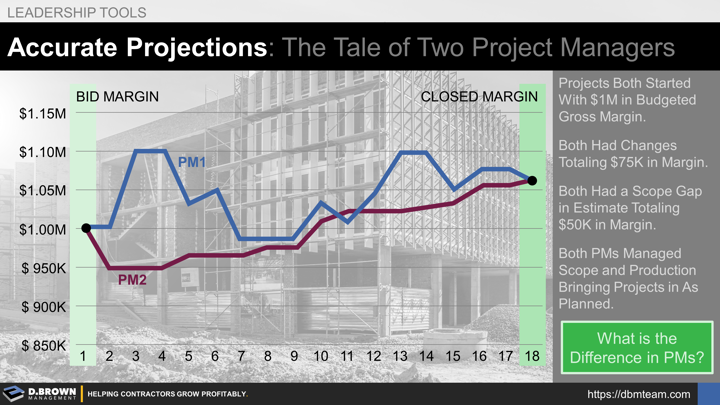

If two projects start and end the same, then why are accurate projections along the way such a big deal? How do they help change the outcome?

In theory, these two Project Managers may have turned out equal projects this time. In practice, there is a much higher correlation between accurate projections during the course of the project and consistently better outcomes.

It is the process of planning that creates the discipline for execution and the learning opportunities across the organization.

"In preparing for battle I have always found that plans are useless, but planning is indispensable." - Dwight D. "Ike" Eisenhower (read more about planning and preparing for unknowns)

This starts before the project is bid with a systematic review of the opportunity. Is this the best opportunity to pursue given our operational capabilities and strategy?

For projects over a certain size before the proposal goes out the door, the operations team should be part of a thorough review to ensure it is constructible as proposed.

Once awarded, a thorough pre-planning process including the working budget are what sets the foundation for effective execution of the project.

During the project there are a series of interrelated processes that ultimately lead to accurate projections, including production tracking, short-interval planning (SIP), pull-planning, committed costs, daily communication and most importantly rigorous project review meetings with a cross-section of the project team.

Predictable project execution removes a lot of risk and stress from a contracting business.

On a scale of 0-10 how would you evaluate the accuracy of your project financials projections over time?