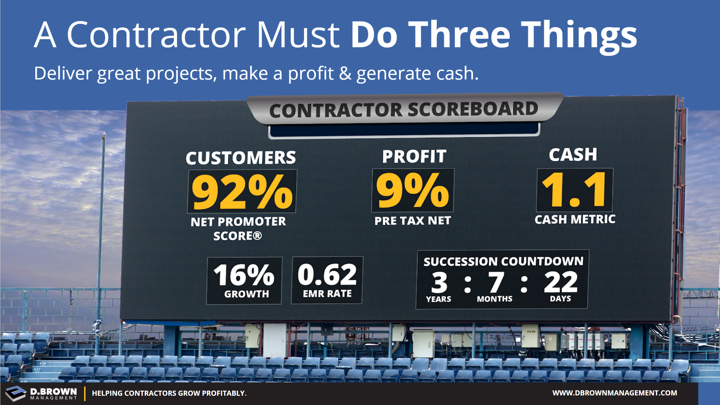

Construction is a capital-intensive business but provides a good return on that investment (ROI). The 2019 Benchmark Report from CLA identifies the average of this return ranging from 18% for civil contractors up to 35% for GCs and MEP/other specialty contractors in the 25-30% range. Your starting point is figuring out how much capital you really need to run your business, what your ROI on that capital is, and how much capital you have available to invest outside the core business.

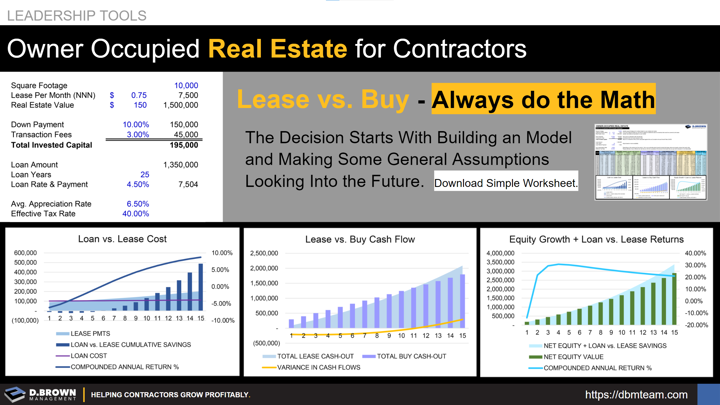

Contact us to get a copy of this template

Disclaimer - This model is not perfect or built for all situations. It will give you a starting point to build upon. As you make a decision like this, run multiple scenarios and create additional tabs for backup. Don't hesitate to schedule some time to talk through this. We are not tax or real estate experts - our advice will be from the perspective of sustainably and profitably growing a construction business over the long-term.

Some basic considerations when looking at lease vs. buy.

- As described above, how much capital do you really need to run your business effectively including looking forward and what has your return been on that capital? The benchmarks above are averages - but remember that averages are just that and your actual performance is what matters most.

- If you aren't exceeding those benchmark averages, would you be better off investing in improving those metrics for your business and is owning your own building the best investment to make at this time?

- Look at your local real estate market and start running some comparisons on how much triple-net (NNN) leases line up with purchasing costs including financing. Depending on supply and demand including how specific your needs are, there may significant disparity between these. The starting numbers used in this model show a market that is basically in alignment where current lease vs. buy costs are very similar.

- Consider what other investments you have available to make both inside and outside your business. Include risk-weighted returns and liquidity. It is against these other possible investments that you must weigh using your capital to invest in real estate.

- Consider how much of your competitive advantage your facility gives you and how much of your overhead it really makes up. For example, depending on the market after 10 years the cost of owning the building versus leasing it could be a 30% annual savings not to mention the equity being built. Owning the facility can be a hedge against increasing lease prices which go hand-in-hand with real estate prices over the longer-term.

- Make some assumptions looking forward about what the average lease costs and real estate values will be going forward. Depending on the market those have ranged from 6-8% annually over the last couple decades, obviously with some major peaks and valleys.

- Understand what both this additional leverage and assets will mean to your financial partners including bank and surety as well as other investors in the business.

- Consider fairness perception issues that may come up if ownership in the business and the real estate are different but interrelated. Or issues that may arise if you have incentive compensation or profit sharing programs that are based on performance metrics that include facility costs in them.

- Know that some of the investments you could make that will have the biggest returns over the long-term will be much harder to calculate. For example investing in building capabilities in a new market that would provide long-term growth and diversification to protect against a downturn may be a better investment. Investing in training and workforce development may have a better long-term impact. It is all about improving your scoreboard.

In summary, there are no easy decisions. It is important to do the math starting with knowing your own score and looking at the trends in the market.

We hope this worksheet helps as a starting point. Contact us to get a copy of this template