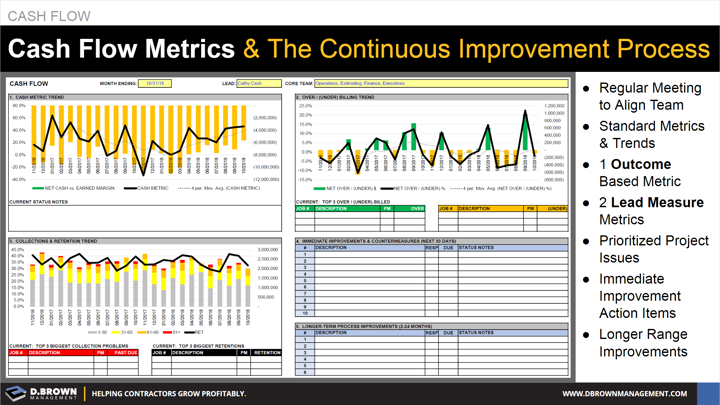

Contractors can focus on 3 major metrics to continuously improve cash flow, truly making a “game” out of it.

- Cash Metric Trend: This is the ultimate outcome-based cash metric at the company level that operations has control over. It looks at your open Work-in-Progress (WIP) projects and compares the net cash against the earned gross margin. Below 100% and you are financing the construction of the project.

- Over / (Under) Billing Trend: A great leading measure and 100% within the control of the project management team utilizing the 18 tips.

- Collections & Retention Trend: Another leading measure that is a joint responsibility of the project management and finance team.

- Identifying the TOP 3 jobs that are the biggest drivers of these lead measures over the last month and then drilling down into them using Root Cause Analysis (RCA) tools to help you see potential improvements.

- Prioritize and execute improvements in the short and long term. Get better during the next cycle just like you do with Field Productivity.

- Utilize A3 Thinking / Reporting techniques for the best results.

Contact us about using a template and process like this for your business.