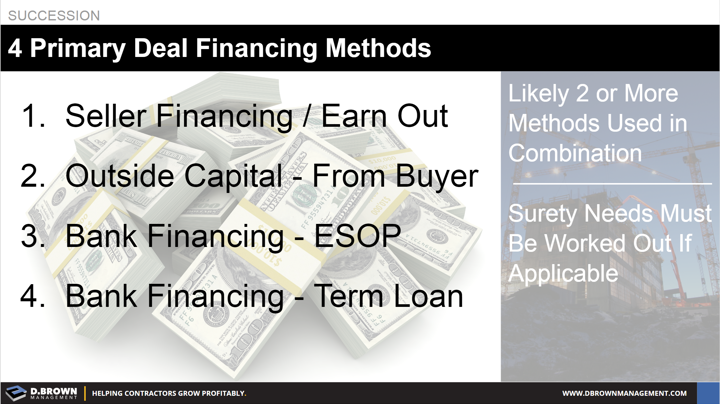

There are four primary sources of financing and most deals will utilize a combination of these.

- Seller financing where the current owner takes their money over time. This may come in the form of:

-

- Progressive buyout by others purchasing a percentage of the shares each year if a sale to management. Or by gifting a percentage of shares each year if a family transaction.

- Note payable to the current owner for the business paid for out of the operating cash flow of the business.

- Outside capital from the buyer with the most likely scenario for a significant amount of outside capital coming in from a strategic buyer.

- Bank financing of an ESOP.

- Bank financing on a term loan for buying the business. This will typically require some combination of outside capital and seller financing, along with proven financial performance, a proven management team, and all 5C’s met.