Developing rigorous weekly Operating Rhythms in your business will help everything run smoother just like they do at the project level.

Like a project, the worst thing you can do is only run cash flow related reports or talk about issues when there are problems. Too much gets overlooked and performance slips.

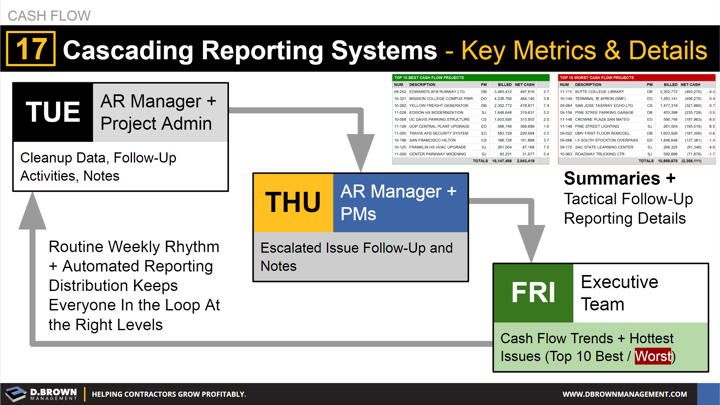

In regard to cash flow, look at creating an automated system to reinforce that operating rhythm. There are many technology tools available that can help with this process.

CONTENT

- Summary: Top 10 best and worst project cash flows + a cash metric trendline over 24 months.

- Details: Tactical details reinforcing the 5/10/15 collection process, organized by Project Manager, Area, etc.

RHYTHM: Pick weekdays and times that work for your company.

- Front-Line: The AR Manager and Project Administration take the first pass at the reporting by clearing up every problem they can, including all 5/10/15 follow-ups.

- Project Management: They handle the first level of escalations before they even become major problems. Keeping them in the loop on cash flow problems helps when they are discussing changes and monthly billings.

- Executive Team: Clear information flow but only after it has been scrubbed by two other layers, so what they see is accurate and actionable for escalation or other business changes if needed.