No contractor should ever lose their ability to compete, win, and build profitable projects using this method of delivery. It keeps your estimating and operations teams sharp.

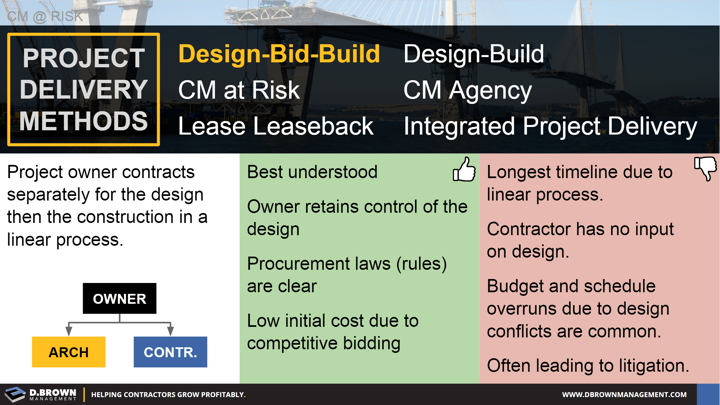

In this method, the project owner contracts separately with the architect for design and a single prime contractor for construction.

- It is the primary procurement method used for public works projects.

- Due to the sequential design followed by the construction workflow, it has the longest timeline.

- Contractors are typically forced into a competitive bidding situation, resulting in a low initial construction cost.

- Because the contractors were not involved in the design phase, there are frequently cost and schedule overruns that sometimes end in litigation.

The negatives must be weighed against the positives for this project delivery method. In many cases this is absolutely the right method for the project.