Project Cash Metric for Work-in-Progress (WIP)

Do your projects burn or build cash? The biggest cash flow variable for a contractor is their projects. Cash flow is a critical scoreboard metric for contractors.

cash flowOver and Under Billing Metric Trend

No amount of excellence in collections will help you get close to 100% if you are continuously under-billed on your Work-in-Progress (WIP) as a whole.

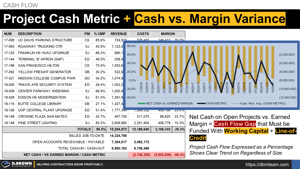

Project Cash Metric and Cash vs. Margin Variance

Contracting is a very capital-intensive business and it is critical to constantly be watching cash flow performance. This metric is the highest level of an “OUTCOME” for cash flow at the project level, summarizing the performance of ops and accounting.

cash flow metricsCollections and Retention Trend Metric

Assuming that a contractor’s project team has done an effective job of aggressively billing the project, the biggest variable that remains for cash flow is the effectiveness of collections.

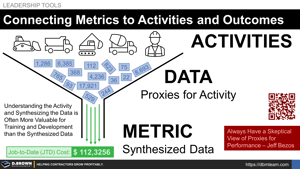

Connecting Metrics to Activities and Outcomes

Outcomes are created through doing the right activities. Data is only a proxy for that activity and a metric is a synthesis of lots of data points. Metrics are valuable, but always have a skeptical view of proxies for performance, especially with growth.

business management scoreboard technologyRecap of the 4 Myths, 18 Tips, 5Cs, and 4 Metrics of Cash Flow

Cash flow is critical for the sustainable growth of a construction contractor and one of their key scoreboard metrics. Here's a recap of the 4 Myths, 18 Tips, 5Cs of Credit, and the 4 Metrics & Trends of Cash Flow.

Integrating Metrics and Organizational Structure

Having a high-level scoreboard for a contractor is just the beginning. The much more valuable part is breaking these high-level scores down into specific and prioritized metrics at each level within each functional area of the organization.

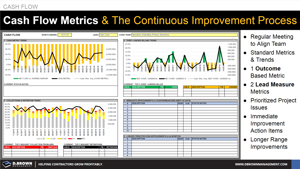

Cash Flow Metrics and The Continuous Improvement Process

Contractors can focus on 3 major metrics to continuously improve cash flow, truly making a “game” out of it.

Cash Flow Tip 18 - Making Cash Flow a Game

Imagine creating a culture where everyone ran into work with the same energy that fans and players run into a sporting event.

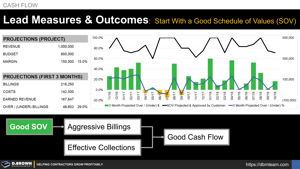

Lead Measures and Outcomes: Starting with the Schedule of Values (SOV)

It is nearly impossible for a contractor to have consistently great cash flow if they have a Schedule-of-Values (SOV) that isn’t loaded properly and integrated with the project schedule, including a projection of the cash flow.