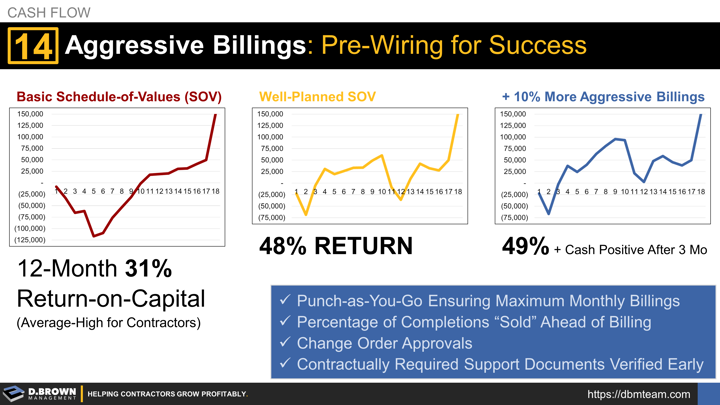

This is in the average-high range for contractors, depending on type.

Our focus is helping contractors achieve performance in the upper end of their peers, including cash flow. Look at the differences that aggressive management of every aspect of billings can make:

- Plan the SOV.

- Manage changes.

- Punchlist the project as you go, ensuring maximum monthly billing values.

- Know the cash flow process and leverage your relationships to ensure billing values are approved before they are formally submitted.

- Know what is contractually required and ensure that these requirements are all met when submitting the billing.